When selecting a forex broker, there are various features that traders evaluate. One of the most important considerations for traders worldwide is the ability to trade in their local currency. For South African traders, the ability to trade with ZAR (South African Rand) accounts can offer a significant advantage.

Being able to deposit, withdraw, and trade in their local currency can help simplify the trading process and eliminate currency conversion fees. Fortunately for them, there are several forex brokers that offer ZAR accounts. In this review, we will look at some of the best forex brokers with ZAR accounts in South Africa, focusing mainly on their key features and benefits.

Key Considerations When Choosing a Forex Broker with ZAR Accounts

Before diving into the list of the best Forex brokers with ZAR accounts, it is essential to understand the key factors we considered when making our selections. We focused on the following criteria to make the selections for this list:

- Regulatory Status – Regulation is one of the most critical factors to consider when choosing a forex broker. For this list, we will prioritise forex brokers under the regulation of the FSCA, the local financial regulator in South Africa. We will also consider the regulations that the barkers have in other regions.

- Trading Platforms – the trading platform is the interface through which traders execute their trades. A user-friendly and feature-rich trading platform can significantly enhance your trading experience.

- Spreads and Commissions – Spreads and commissions are the primary costs associated with forex trading. It is essential to compare the spreads and commissions of different brokers to find the most cost-effective option.

- Trading Instruments – We will also consider the range of trading instruments offered by the broker. A broker that offers a deep collection of market products allows its traders to diversify their portfolios as they wish.

Traders may also need to consider the minimum deposit of a broker, the deposit and withdrawal methods, and the customer support of the brokers alongside the factors highlighted above. Most brokers that support ZAR accounts also offer local deposit and withdrawal options through major South African banks like Capitec Bank, Standard Bank, FNB, and Nedbank, ensuring a secure and ultra-fast funding process.

With that said, let’s take a look at some of the best forex brokers with ZAR accounts in South Africa.

HFM

HFM is an excellent choice for South African traders looking for a forex broker that supports ZAR accounts. This broker is popular for its no minimum deposit requirement on most of its accounts. Specifically, HFM does not have a minimum deposit requirement to open Premium, Cent, Zero, and Top-up Bonus accounts. However, the Pro account has a minimum deposit of $100/1,800 ZAR and the Pro-Plus has a minimum deposit of $250/4,700 ZAR. There are plenty of payment options supported for deposits and withdrawals including Neteller, Skrill, wire transfers, credit and debit cards, PayRedeem, Fasapay, Mobile Money systems like M-Pesa, and cryptocurrencies.

Upon making a successful deposit, traders can speculate on a variety of market products. HFM grants access to CFDs on forex, energy, indices, stocks, metals, bonds, commodities, cryptocurrencies, and ETFs. Traders can access these markets through the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside the broker’s own HFM Platform.

When it comes to trading costs, HFM offers competitive spreads depending on the account that a trader uses. The Premium account has spreads starting from 1.2 pips, while the Cent account offers spreads as low as 1.0 pip. The Top-up Bonus account, available in some regions like South Africa, has spreads from 1.4 pips. For lower spreads, the Pro account starts at 0.5 pips, and the Pro-Plus account offers spreads from 0.2 pips. None of these accounts charge a commission on forex pairs. Meanwhile, the Zero Spread account offers spreads from 0.0 pips but charges a commission of $3 per lot per side.

Regarding regulations, HFM operates under the regulation of the FSCA in South Africa, alongside other regulators. It also has regulatory supervision by the CySEC in Cyprus, the DFSA in the DIFC, the FCA in the UK, and the CMA in Kenya.

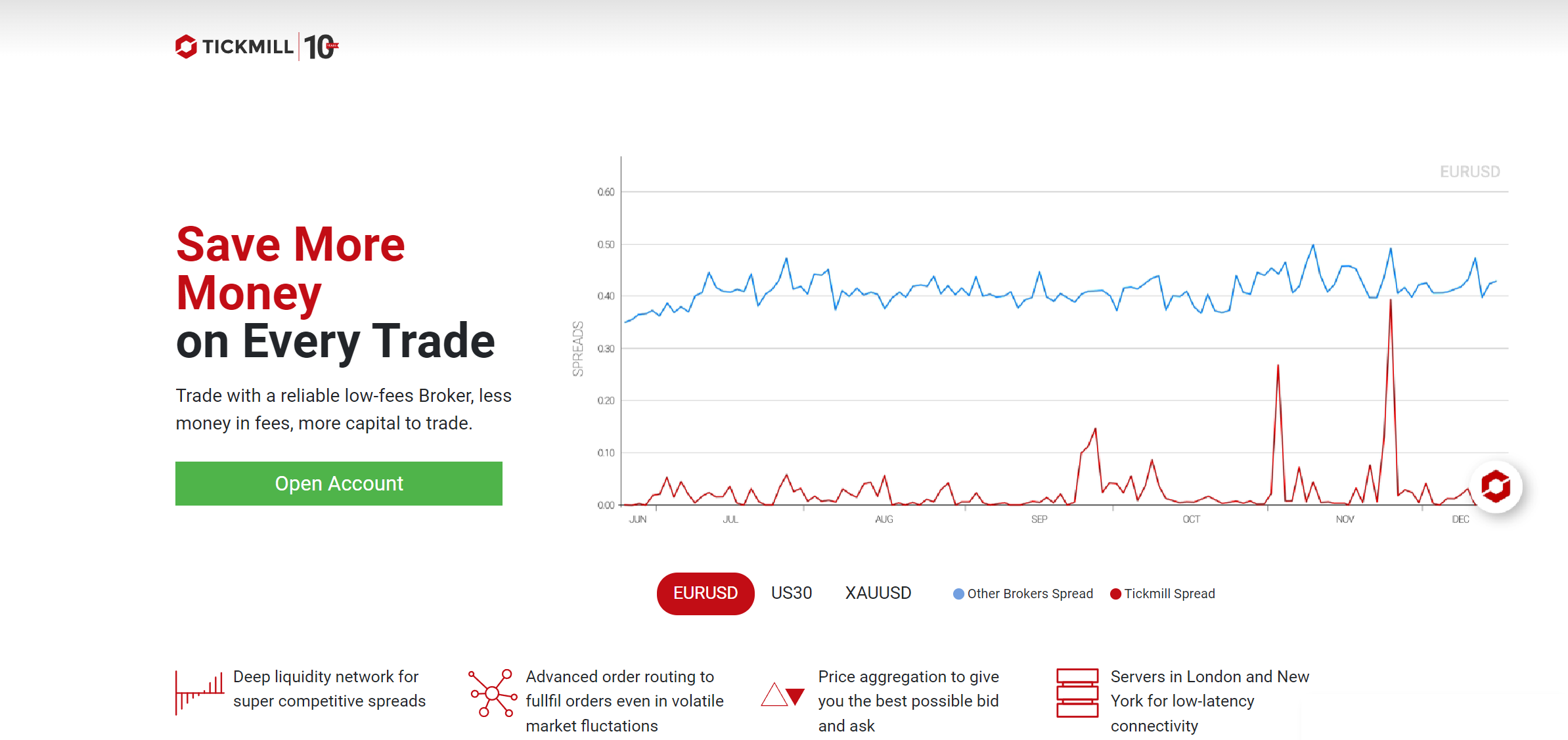

Tickmill

Tickmill is another reputable forex broker offering ZAR accounts. The broker offers ZAR as a base currency, allowing South African traders to deposit, withdraw, and trade in their local currency. Tickmill requires a minimum deposit of only 179 ZAR to open a live trading account. When depositing in USD, the minimum deposit required is $100. Traders can fund their accounts using a variety of methods, including Skrill, Neteller, Sticpay, Fasapay, credit/debit cards, USDT, UnionPay, and WebMoney.

Tickmill provides access to a wide range of trading instruments, allowing investors to diversify their portfolios. Specifically, Tickmill offers CFDs on forex, stock indices, metals, bonds, commodities, and cryptocurrencies. Traders can access these markets through MetaTrader 4, MetaTrader 5, and the Tickmill Trader platform.

Tickmill is known for its competitive pricing, offering tight spreads across its various account types. The broker provides spreads starting as low as 1.6 pips for major currency pairs on its Standard account, with no commission charged. Additionally, it offers two Raw Spread accounts, featuring spreads from 0.0 pips along with a commission that varies by account type. The Raw account has a commission of $3 per side per lot, while the Tickmill Trader Raw account charges $3.5 per side per lot.

On regulations, this broker operates with regulatory oversight from a variety of organisations. It operates under the supervision of the FSCA in South Africa, the FCA in the UK, the CySEC in Cyprus, and the DFSA in Dubai, among others.

Exness

Exness is one of the top forex brokers with a ZAR account in South Africa. This broker supports the ZAR as a base account currency and accepts one of the lowest minimum deposits by any broker. To open an account with Exness, traders need to make a deposit of at least $10.

This converts to approximately 185 ZAR at the time of writing this. This low entry point is one of the reasons Exness stands out among forex brokers with ZAR accounts. There are various deposit and withdrawal methods supported by Exness including Neteller, Skrill, Wire Transfers, Credit and Debit cards, and Mobile Money e.g. M-Pesa.

Once traders make a deposit, they can go ahead and trade a variety of global market products. This broker allows its clients to trade CFDs on forex, indices, commodities, cryptocurrencies, and stocks. On another note, this broker provides several market-standard platforms including MT4, MT5, and its own Exness Terminal.

The spreads for trading on Exness vary depending on the type of account a trader uses. Its Standard account features spreads starting from 0.2 pips with no commission. The Standard Cent account offers favourably low spreads from 0.3 pips without any commission. The Pro account also offers commission-free trading, with even tighter spreads starting from 0.1 pips.

On the other hand, the Zero account offers spreads starting from 0.0 pips on the top 30 instruments but charges a commission starting at $0.05 per side per lot. Meanwhile, the Exness Raw Spread account offers spreads from 0.0 pips, but with a commission of up to $3.5 per side per lot.

Finally, Exness operates in South Africa under the regulation of the FSCA. Additionally, it has regulations from the FCA in the UK, the CMA in Kenya, and the CySEC in Cyprus, among others.

XM

XM is a well-established online broker that also caters to South African traders with ZAR accounts. This support of the ZAR as an account currency allows South African traders to deposit, withdraw, and trade in their local currency without incurring unnecessary conversion fees. XM requires a minimum deposit of $5 to open a live trading account. This converts to approximately 95 ZAR, making it one of the most accessible brokers for traders with limited capital. The broker supports a variety of deposit and withdrawal methods, including Skrill, Neteller, PayPal, bank wire transfers, and credit/debit cards.

XM supports the popular MetaTrader 4 and MetaTrader 5 trading platforms and its own XM Trading app. These trading platforms allow investors to access a deep collection of over 1,400 assets. These include CFDs on forex, equity indices, shares, cryptocurrencies, commodities, metals, stocks, and energies.

When it comes to trading costs, XM offers competitive spreads starting from 1.6 pips on the standard account. They go even lower on the XM Ultra Low account beginning at just 0.8 pips. Both do not charge a commission. Meanwhile, the Shares account charges a commission depending on the share and the size of the trade.

Finally, XM operates under the strict regulation of multiple financial authorities. These include the FSC in Belize, the CySEC, the ASIC, and the DFSA.

Plus500

Plus500 is a globally recognised CFD broker that also offers ZAR accounts for South African traders. The minimum deposit accepted by this broker is $100 which approximately converts to 1,850 ZAR at the time of writing this. Deposits and withdrawals can be made through various methods, including Skrill, Neteller, credit/debit cards, and bank transfers.

Notably, Plus500 offers its traders over 2,800 market products across various global markets. In particular, South African traders have access to CFDs on forex, cryptocurrencies, indices, commodities, shares, options, and ETFs. Traders can access these markets through the broker’s proprietary trading platform, Plus500.

Plus500’s pricing model typically involves spreads with no commission charged. Spreads can be as low as 0.8 pips for major currency pairs depending on market conditions. Plus500 is regulated by multiple financial authorities, including the FSCA in South Africa, the FCA, the CySEC, and the ASIC.

FxPro

FxPro is another reputable forex broker that offers ZAR accounts, making it a strong choice for South African traders. The broker supports deposits, withdrawals, and trading in South African Rand, helping traders avoid unnecessary currency conversion fees. The minimum deposit required to open an account with FxPro is $100 (approximately 1,850 ZAR). The broker provides multiple payment options, including bank transfers, credit/debit cards, Skrill, Neteller, and PayPal.

FxPro offers a diverse range of trading instruments, including CFDs on forex, indices, futures, shares, and cryptocurrencies. The broker supports several trading platforms including cTrader, MetaTrader 4, MetaTrader 5, and FxPro’s own platform. These platforms are known for their advanced charting tools, automated trading capabilities, and user-friendly interfaces.

Regarding trading costs, FxPro offers competitive spreads depending on the account type used. Spreads on the Standard account start from 1.2 pips with no commission. In contrast, the Raw+ and Elite accounts have spreads from 0.0 pips plus a commission of $3.5 per side per lot.

In terms of regulation, FxPro is a well-regulated broker with oversight from multiple authorities. These include the FSCA in South Africa, the FCA, the CySEC, and the SCB in the Bahamas.

BlackBull Markets

Next up is BlackBull Markets. It is a globally recognized forex broker that supports ZAR accounts for South African traders. The broker allows traders to deposit, withdraw, and trade in ZAR, helping them avoid currency conversion fees. Interestingly, this broker does not have a minimum deposit requirement to open a trading account. This means that traders can start trading with whatever amount they wish to invest. There are several deposit and withdrawal methods supported including Skrill, Neteller, credit/debit cards, wire transfers, Apple Pay, and Google Pay, among others.

BlackBull Markets offers traders access to a wide range of financial instruments across multiple markets. Through this broker, clients can trade CFDs on forex, commodities, indices, shares, and cryptocurrencies. The broker supports the widely used MetaTrader 4, MetaTrader 5, and TradingView platforms. Interestingly, it is one of the brokers that offers TradingView paid plans for free to its traders.

To accommodate different trading styles, BlackBull Markets provides three account types. These include the ECN Standard, the ECN Prime, and the ECN Institutional accounts. The ECN Standard account features spreads starting from 0.8 pips with no commission. For traders looking for lower spreads, the ECN Prime account offers spreads from 0.1 pips with a $6 commission per lot. Meanwhile, the ECN Institutional account provides the tightest spreads, beginning at 0.0 pips, with a $4 commission per lot.

BlackBull Markets operates under the regulatory oversight of the FMA and FSPR in New Zealand, as well as the FSA in Seychelles. It’s important to note that BlackBull Markets does not have FSCA regulation.

Why Choose a Forex Broker with a ZAR Account?

Trading with a South African Rand (ZAR) account comes with numerous benefits, particularly for traders based in South Africa. These include:

- No Currency Conversion Fees – With a ZAR account, South African traders avoid unnecessary currency conversion costs that arise when using other currencies. This saves money, particularly for frequent traders.

- Faster Deposits and Withdrawals – ZAR transactions within South Africa are typically faster than cross-border currency exchanges.

- Protection Against Exchange Rate Fluctuations – By trading in ZAR, traders are not affected by fluctuations in foreign exchange rates. This provides stability and predictability in their trading funds.

- Simplified Accounting and Budgeting – Managing your trading account in your local currency simplifies calculations and financial record-keeping. It also makes budgeting and risk management more straightforward.

Final Comments

Choosing a forex broker with a ZAR account can significantly benefit South African traders. These include cost savings on currency conversion fees, faster transactions, and protection from exchange rate volatility. In this article, we highlighted some well-regarded forex brokers that offer ZAR accounts in South Africa. Each broker offers unique advantages, such as low minimum deposit requirements, advanced trading tools, and user-friendly platforms

However, this is not an exhaustive list. Ultimately, selecting the best forex broker will depend on individual trading preferences. It’s crucial to conduct thorough research and compare brokers before making a decision. Moreover, broker offerings may change with time. Always verify the latest information on the broker’s website before you choose to invest with them.

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.