The Abu Dhabi Securities Exchange (ADX) is a leading stock exchange located in Abu Dhabi, United Arab Emirates. Established in 2000, it operates under the supervision of the Securities and Commodities Authority (SCA) of the UAE. ADX facilitates the trading of securities, including equities, ETFs, bonds, and other financial instruments.

To trade ADX-listed instruments, traders need to partner with a broker that gives them access to these products. Luckily, there are several brokers that do exactly that. In this article, we will take a closer look at ADX brokers, particularly, the list of firms supporting trading stocks from the Abu Dhabi Securities Exchange.

Our Criteria for Selecting ADX Brokers

Selecting the right broker is a critical decision for any investor. When selecting brokers to trade ADX-listed instruments, consider the following:

- Regulation – It is very important to only trade with a well-regulated broker. Prioritise brokers regulated in the UAE when selecting ADX brokers.

- Brokerage Fees and Commissions – It’s important to consider the fees involved when trading with a broker. Compare costs across different brokers to find the most cost-effective option.

- Market Access – Another important factor to consider is the range of market products the broker supplies. Ensure they have an ample supply of ADX-listed stocks and other market products for portfolio diversification.

- Trading Platforms – Evaluate the broker’s trading platform, considering its user-friendliness, features, and mobile accessibility. A robust platform with real-time data, charting tools, and fast order execution capabilities is essential.

Now that we understand how this list of firms supporting ADX stock trading is developed, let’s take a look at some of the best ADX brokers.

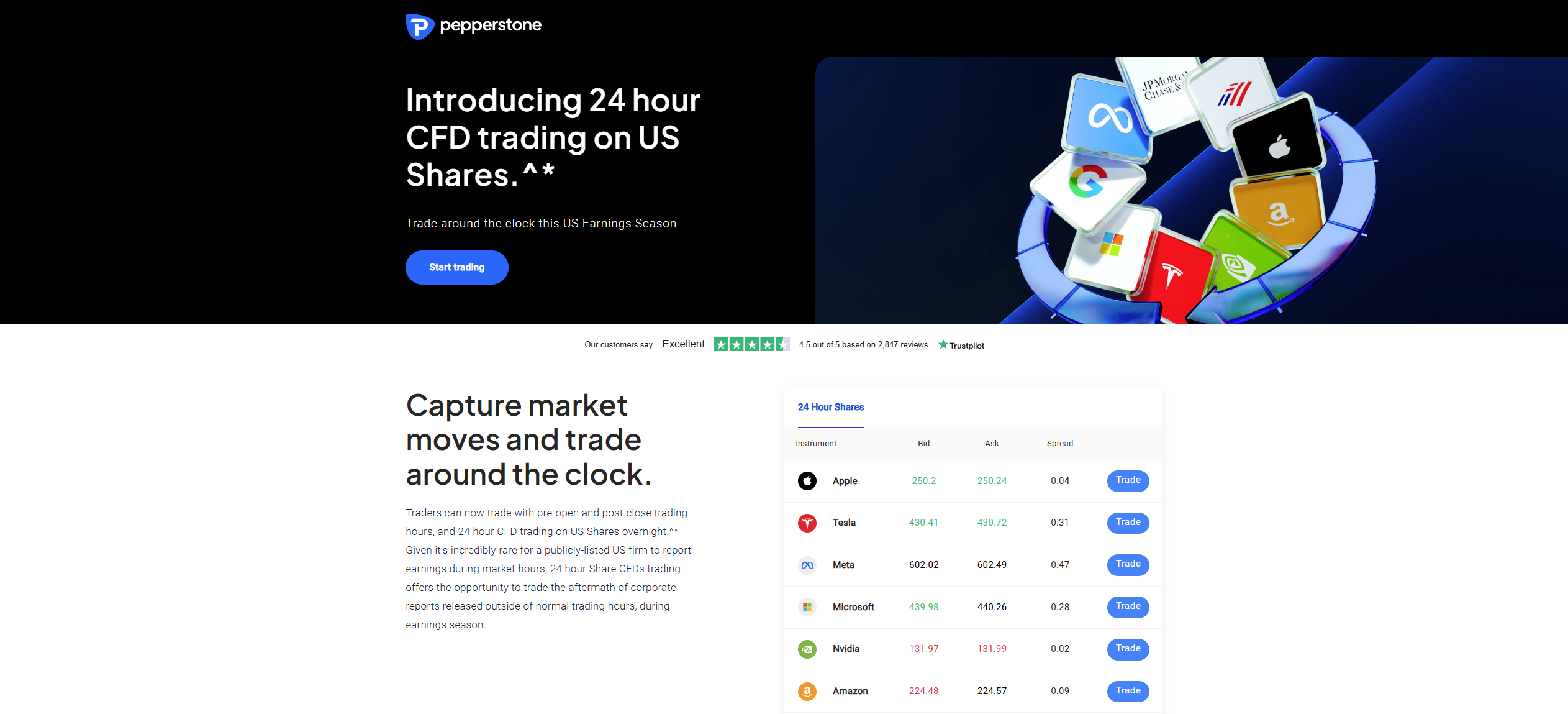

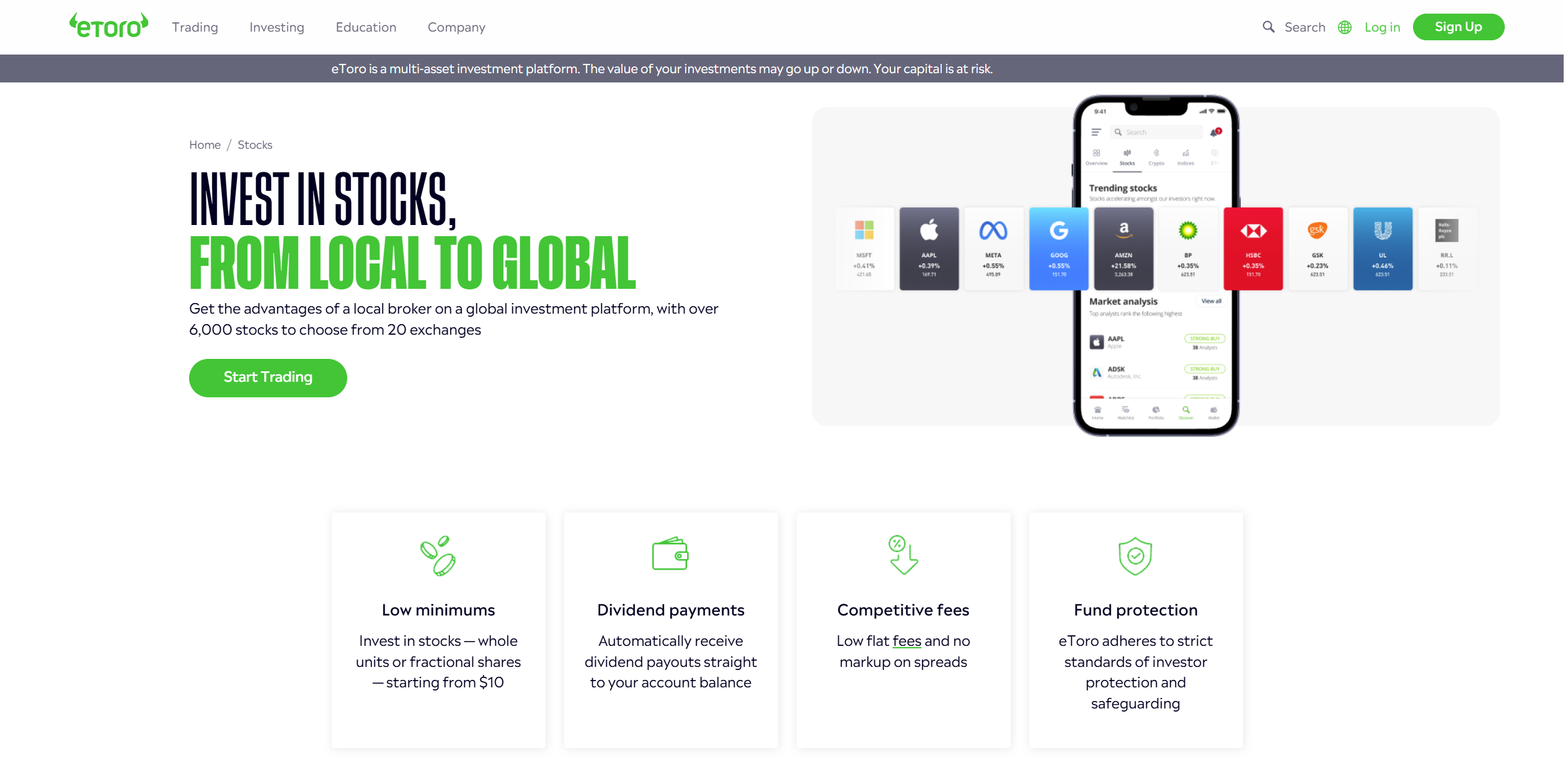

eToro

In Dec 2024, eToro and the Abu Dhabi Securities Exchange announced an agreement to add a number of ADX-listed stocks to the eToro platform. eToro’s users can now invest in a number of ADX-listed companies across various sectors. These include energy, real estate, banking, finance, technology, and healthcare. This allows traders to invest in some of the fastest-growing companies.

Furthermore, traders can invest in a deep collection of other stocks. In particular, eToro offers over 6,000 stocks from 20 different global stock exchanges. Notably, eToro offers stock trading both as real underlying assets and as CFDs.

Further, eToro also offers trading in other global markets other than stocks. Specifically, eToro’s users have access to CFDs on forex, commodities, ETFs, indices, and cryptocurrencies. Traders can also trade cryptocurrencies as real underlying assets. The trading platform available to use is the broker’s own aptly named, eToro platform. It comes with the proprietary CopyTrader technology that allows users to replicate the moves of other investors of their choice.

On another note, eToro offers competitively low fees when trading. Stock CFDs charge a spread of 0.15% on this broker site. In contrast, when trading real stocks, a commission of $1 or $2 may apply when opening and closing a stock position depending on your country of residence and the stock exchange on which the asset is traded.

Regarding regulations, eToro features a robust supervisory background. In the UAE, eToro is licensed and regulated by the Abu Dhabi Global Market (ADGM)’s FSRA. additionally, the broker is regulated by the ASIC in Australia, the FCA in the UK, and the CySEC in Cyprus, among others.

Emirates NBD Securities

Emirates NBD Securities is a prominent brokerage firm in the UAE that provides access to ADX-listed stocks. As a subsidiary of Emirates NBD, one of the largest banks in the UAE, the broker offers a wide range of financial services tailored to investors in the region. Clients can trade instruments listed on the ADX and other exchanges like the Dubai Financial Market. Traders can trade the various market products through the broker’s advanced trading platforms, which include both web-based and mobile solutions.

Interestingly, Emirates NBD Securities does not reveal the fees charged when trading. On a good note though, Emirates NBD securities is well-regulated in the UAE. This broker operates under the supervision of the Securities and Commodities Authority (SCA) of the UAE. This ensures a high level of trust and compliance with local regulations.

ADCB Securities

ADCB Securities is another well-established brokerage firm in the UAE that offers access to ADX-listed securities. As a subsidiary of Abu Dhabi Commercial Bank (ADCB), it leverages its parent company’s strong financial foundation and extensive network. This broker offers a variety of instruments including equities, bonds, and other instruments listed on ADX and the Dubai Financial Market.

The brokerage features state-of-the-art trading platforms, including a user-friendly online platform and a mobile app. On another note, trading on ADCB Securities features a variety of fees. For ADX-listed instruments, traders pay a broker’s commission of 0.125% of trade value and a market commission of 0.025% of trade value.

Finally, ADCB Securities operates under the regulatory oversight of the Securities and Commodities Authority (SCA). While regulations alone are not enough, they offer a level of protection to client funds.

FAB Securities

FAB Securities is another leading brokerage firm in the UAE providing access to the ADX. As a subsidiary of First Abu Dhabi Bank (FAB), the largest bank in the UAE, FAB Securities benefits from its parent company’s strong reputation and extensive resources. The firm offers a comprehensive selection of instruments, including equities, bonds, ETFs, and other securities on the Abu Dhabi Securities Exchange (ADX) and Dubai Financial Market.

To trade these market products, FAB Securities offers its in-house web-based platform alongside its mobile app. These platforms have user-friendly interfaces, designed for both experienced and novice investors. When trading ADX-listed products, a fee of 0.15% plus 5% VAT applies. Similar to other UAE-based brokers, FAB Securities is regulated by the SCA in the UAE. This means they implement investor protection standards in accordance with local regulations.

Al Ramz Capital

Al Ramz Capital is a well-established ADX broker providing access to ADX-listed securities and a broad range of other financial products including equities, derivatives, fixed incomes, and futures. It also offers access to instruments from other global exchanges including DFM, NSDQ, NYSE, and more.

Al Ramz Capital’s Unified trading platform is mobile-based with a lot of advanced capabilities. These include copy trading, automated trading through a robo advisor called Thor, and even social trading. Unfortunately, Al Ramz Capital does not publicly disclose its fee structure. However, as a reputable regulated institution, they are likely to offer competitive pricing for their clients. Speaking of regulations, Al Ramz Capital operates under the supervision of the Securities and Commodities Authority (SCA) of the UAE. This regulatory compliance ensures that the broker operates in line with best practices for clients.

ADSS

The last broker we will cover here is ADSS. ADSS is a leading broker in the UAE that provides access to ADX-listed securities and a wide range of other financial instruments. Based in Abu Dhabi, ADSS operates under the regulation and authorisation of the Securities and Commodities Authority (SCA) of the UAE.

The broker charges competitive fees, but specific rates for ADX products can vary. When trading UAE shares, traders pay a fee of 1 AED for a trade size of 0.001. Notably, ADSS offers trading in other global market products. Some of the other global markets that traders have access to include forex, indices, bonds, commodities, cryptocurrencies, equities, and ETFs. There are only two trading platforms available, including MetaTrader 4 and the ADSS platform.

Closing Remarks

ADX brokers play a vital role in facilitating access to the Abu Dhabi Securities Exchange. Partnering with a reliable broker is crucial to accessing these opportunities and ensuring a seamless trading experience. The brokers listed in this article stand out for their regulatory compliance, robust platforms, and tailored services for trading ADX-listed securities.

Admittedly, this is not meant to be an exhaustive list. This list is meant to provide a starting point for investors seeking to trade assets listed on the ADX. It’s crucial to conduct thorough research and compare offerings from different brokers to find the best fit for your individual investment needs and risk tolerance.