In forex trading, there are a variety of trading accounts available to traders. Choosing the right account for your needs and strategy is crucial for the best trading experience. Two of the most popular trading accounts offered by brokers include Raw Spread accounts and No Commission (Standard) accounts.

Both have their unique features, advantages, and disadvantages. It is essential for traders to understand the differences between these accounts before deciding which one suits their trading style and goals. In this article, we will evaluate the various features of raw spread accounts vs no commission (standard) accounts in an attempt to determine which is better. Let’s begin.

What is a Raw Spread Account?

A raw spread account is a type of trading account that gives traders access to interbank market rates. This gives traders access to the tightest possible spreads, usually without any markup from the broker. The spreads on these accounts start from as low as 0.0 pips but they usually charge an accompanying commission per side per lot. These accounts are typically favoured by professional traders and high-volume traders like scalpers.

Advantages of Raw Spread Accounts

- Ultra-tight spreads – Raw spread accounts usually offer the lowest spreads possible, which reflect real market conditions.

- Cost Transparency – Raw spread accounts give traders access to interbank market prices with no spread markups, promoting transparency. Any commissions involved are also revealed beforehand.

- Lower Trading Costs for Active Traders – With minimal spreads, traders can save on transaction costs. Nonetheless, it’s important to remember that commissions are usually charged on these accounts.

- Better Execution – Direct access to liquidity providers often leads to faster execution speeds and reduced slippage.

Disadvantages of Raw Spread Accounts

- Commission Costs – While spreads are low, the additional commission per trade can add up, especially for low-volume traders.

- Higher Minimum Deposit – A lot of brokers often require a higher minimum deposit for raw spread accounts.

- Not Ideal for Trading Newcomers – The commission structure and higher deposit requirements may not be suitable for traders starting out.

Who is The Raw Spread Account Best Suited For? – Raw Spread accounts are mostly best suited for high-volume traders like scalpers, high-frequency traders, and day traders. These strategies execute a large number of trades in a short time which require the tightest spreads in the market.

What is a Standard (No Commission) Account?

A standard (no commission) account is a type of trading account where the broker generates its revenue from the spread. Typically, brokers add a markup to their spreads which is built into the price of the assets being traded. These accounts do not charge a commission to traders but the spreads are wider than on raw spread accounts. These accounts are most suitable for traders who prefer simplicity and may not engage in high-frequency trading.

Advantages of Standard (No Commission) Accounts

- No Commission – These accounts offer a straightforward and easy-to-understand fee structure with no commissions.

- Lower Minimum Deposit – Standard accounts often require lower minimum deposits, making them more accessible to traders with smaller capital.

- Suitable for Less Experienced Traders – The simplicity and lower deposit requirements make Standard accounts ideal for new traders.

- Predictability – Some brokers offer fixed spreads on their standard accounts, providing more predictable trading costs. This makes it easier to budget and plan trades.

Disadvantages of Standard (No Commission) Accounts

- Wider Spreads – Spreads are typically wider on standard accounts than on Raw Spread accounts, potentially increasing trading costs.

- Less Pricing Transparency – Traders may not always be aware of the exact spread they are paying and the markup they are paying to the broker. Unlike commission-based accounts, where most of the costs are clearly stated as a flat fee (commissions), in standard accounts, the cost is embedded within the spread.

- Potential for Higher Costs – The higher spread can lead to significantly higher costs, especially for high-volume traders.

Who is The Standard (No Commission) Account Best Suited For? – Standard accounts are best suited for aspiring traders or those who prefer a simplified fee structure and engage in low-volume trading. Moreover, standard accounts probably have the lowest minimum deposit requirement on broker sites, making them accessible to most traders.

Difference Between Raw Spread and Standard Account

The main difference between a raw spread and a standard account is the cost structure. As detailed above, raw spread accounts offer access to direct market prices with no added markup. Brokers usually charge a commission on raw spread accounts to cover the cost of trading. So generally speaking Raw Spread Accounts have ultra-low spreads and some commission fees.

In contrast, standard accounts add a markup to raw market spreads to cover trading costs. On one hand, raw spread accounts offer a more transparent and cost-effective trading experience, especially for high-volume traders. On the other hand, standard accounts offer a more simplified trading experience fitting most trader profiles, especially people who are new to trading. So generally speaking Standard (no Commission) Accounts have a bit higher spreads and no commission fees.

What Top Brokers offer both Raw and Standard Accounts?

Almost every forex broker in existence offers a standard account. It is the most common trading account on broker sites. However, there are several brokers that offer both standard and raw spread accounts. In this section, we will highlight a few brokers that offer both raw spread and standard accounts.

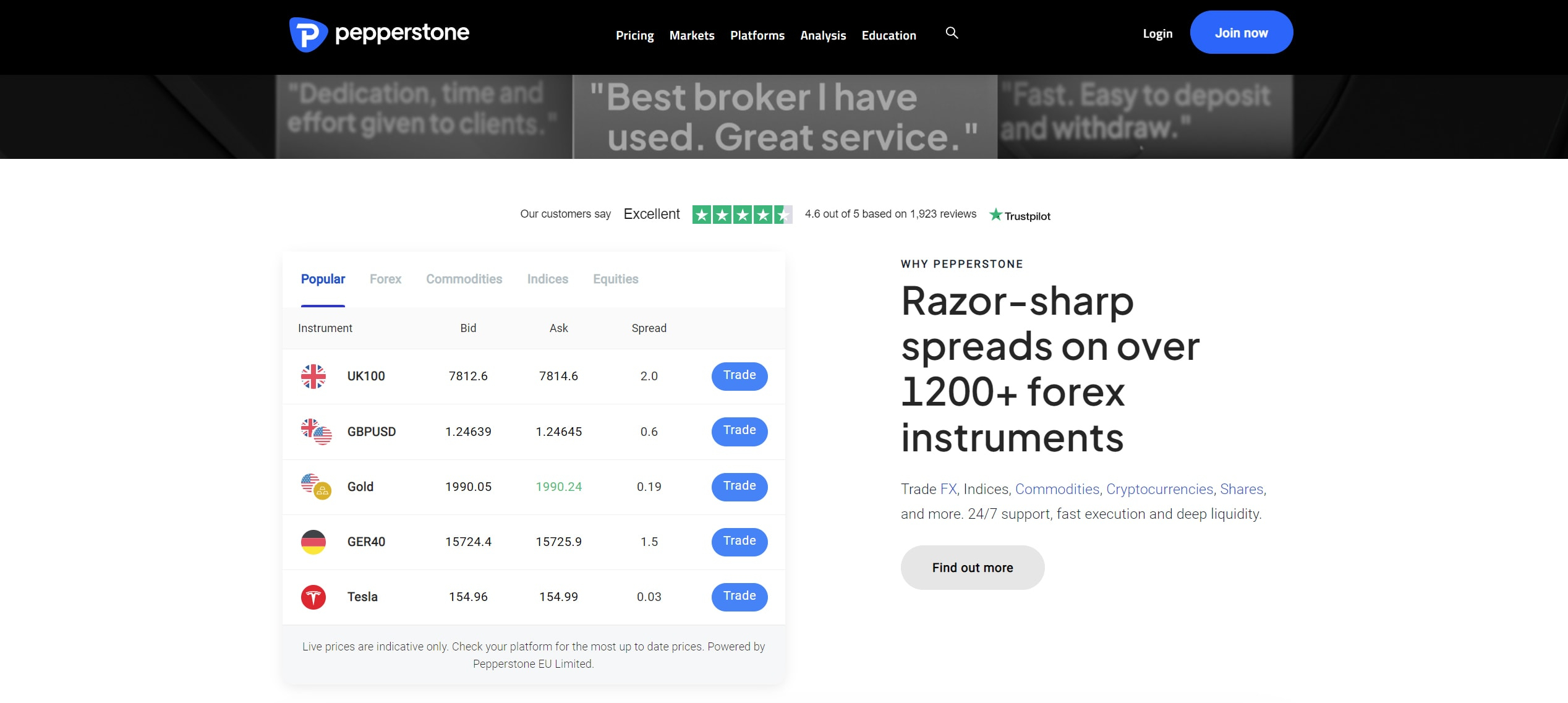

Pepperstone

Pepperstone is a globally recognised broker that offers both a standard and a raw spread account. As such, the broker accommodates a wide range of trader profiles. The standard account offered by this broker has a spread as low as 1.0 pips on majors with no commission charged. In contrast, the raw spread account called the razor account has spreads from 0.0 pips but also charges a commission depending on the trading platform a trader uses.

Traders using MetaTrader 4 and MetaTrader 5 pay a commission of $3.5 or €2.6 or £2.25 or CHF 3.30 per side per lot depending on the account currency. TradingView and Pepperstone Trading Platform users also pay a commission of $3.5 per side per lot. Meanwhile, cTrader traders pay a commission of $3 per side per lot. For TradingView, cTrader, and Pepperstone Trading Platform users with accounts in currencies other than USD, the commission is converted at the prevailing spot rate into their account’s currency. There is no minimum deposit requirement on either account offered by Pepperstone.

Positively, Pepperstone provides a deep collection of market products with over 1,200 different assets available. These include CFDs on forex, commodities, indices, stocks, cryptocurrencies, and ETFs. This allows investors to diversify their portfolios as they see fit. On another note, Pepperstone has regulations from several institutions including the FCA in the UK, the CySEC in Cyprus, the ASIC in Australia, the BaFin in Germany, and several other organisations.

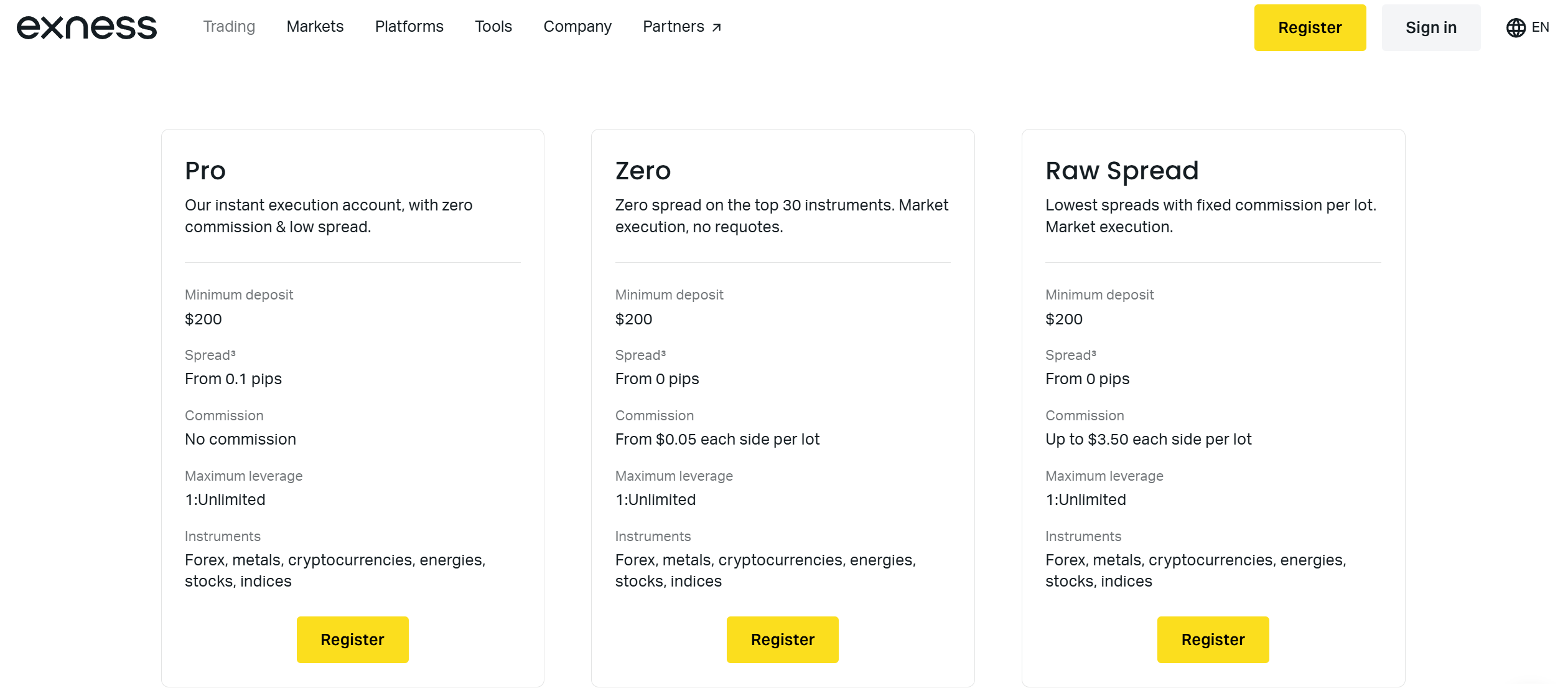

Exness

Exness is another leading forex broker that offers a standard account along with raw spread and zero spread accounts, catering to a wide range of traders. This broker’s standard account offers spreads from as low as 0.2 pips for major currency pairs with no commission charged. It also offers a standard cent account that allows investors to trade with a cent-denominated account. Further, Exness offers its raw spread account with spreads from 0.0 pips plus a commission of up to $3.5 per side per lot. The raw spread account on Exness requires a minimum deposit of $200* while the standard account requires just $10.

Notably, Exness allows its traders to diversify their portfolios by offering access to a variety of global markets. On this broker site, investors gain access to CFDs on forex, metals, cryptoсurrencies, energies, stocks, and indices. The trading platforms available to use include MetaTrader 4, MetaTrader 5, Exness Terminal, and Exness Trader app.

Regarding regulations, this broker has great oversight. It operates under the supervision of a variety of organisations. These include the FCA in the UK, the CySEC in Cyprus, the FSCA in South Africa, and the CMA in Kenya, among others.

While Exness accepts traders from most countries around the world, they do not accept retail clients from the UK and EEA countries, among others.

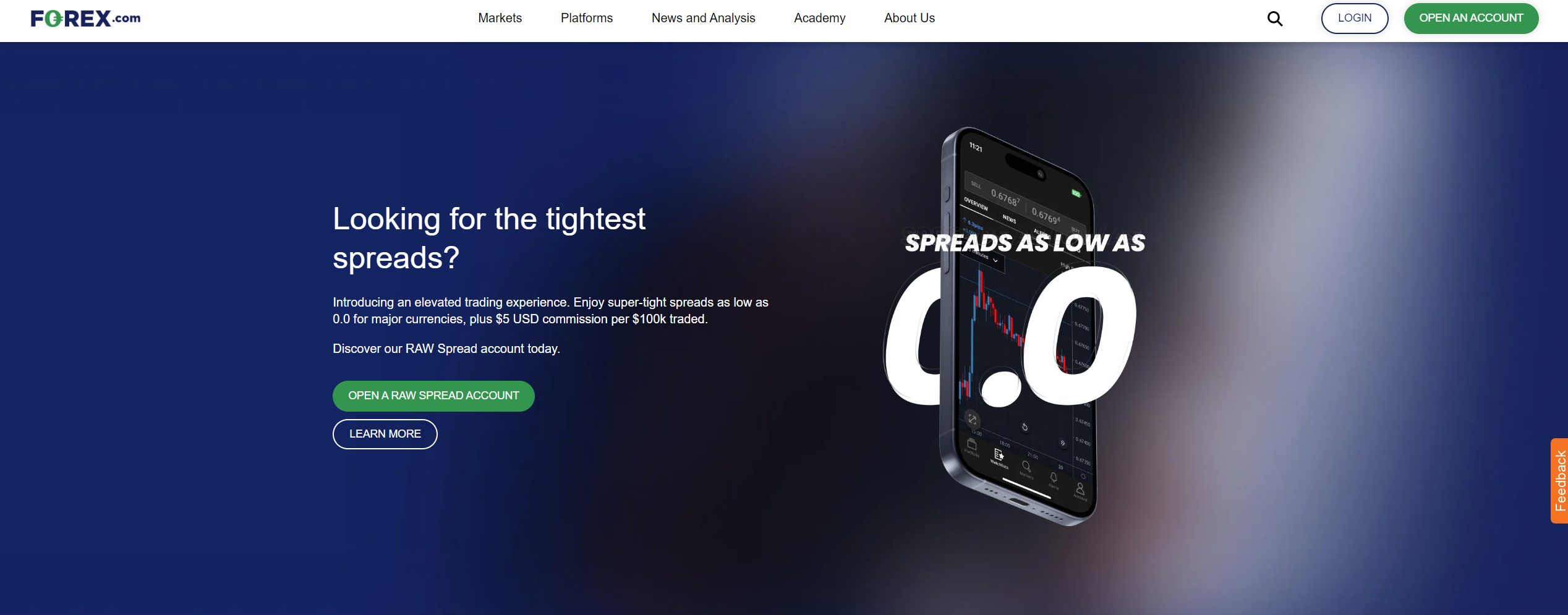

Forex.com

Forex.com offers both standard and raw spread accounts to its traders in the US and outside the US. The standard account for all traders offers spreads from as low as 0.8 pips for major currency pairs with no commission charged. In contrast, the raw spread account offers spreads from 0.0 pips for major currency pairs and a commission depending on where a trader is from. For US-based traders, the commission sits at $7 per $100,000 traded. In contrast, traders outside the US pay a commission of $5 per $100,000 traded. The minimum deposit required to open either account on Forex.com is $100.

Further, the assets that traders have access to depend on where they are located. Traders outside the US have access to CFDs on forex, stocks, indices, cryptocurrencies, commodities, and precious metals. In comparison, traders in the US can trade forex, futures, and futures options. The trading platforms available to use include MT4, MT5, Forex.com Trader, and TradingView.

On another note, this broker has one of the most extensive regulatory backgrounds for any broker. Its parent company, StoneX, has regulations by the CFTC and the NFA in the US, the ASIC, the CySEC, and the FCA, among others.

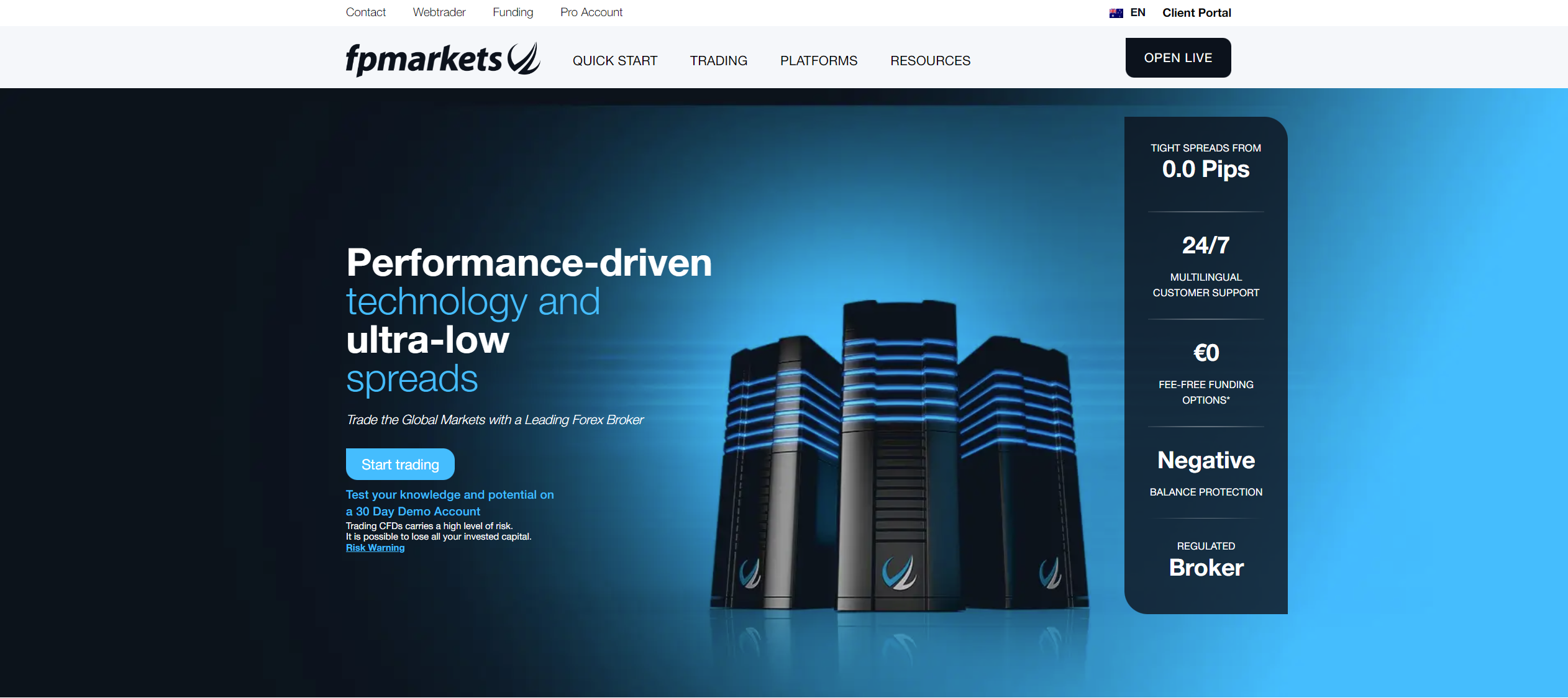

FP Markets

FP Markets offers one of the deepest collections of market products in the world. This broker offers more than 10,000 different CFDs on forex, indices, commodities, stocks, metals, ETFs, bonds, and cryptocurrencies. To trade these markets, traders can use TradingView, MetaTrader 4, MetaTrader 5, and cTrader.

There are two different accounts available to use, including a standard and a raw spread account. The standard account features spreads from 1.0 pips for major currency pairs with no commissions charged. On the other hand, the raw spread account offers spreads from 0.0 pips plus a commission of $3 per side per lot. FP Markets requires a minimum deposit of $100 to open either account.

On regulations, this broker holds licenses from various institutions. These include the CySEC, the ASIC, the FSCA, and the CMA, among others. While regulations alone are never enough, brokers with multiple regulatory licenses are considered safer than those without.

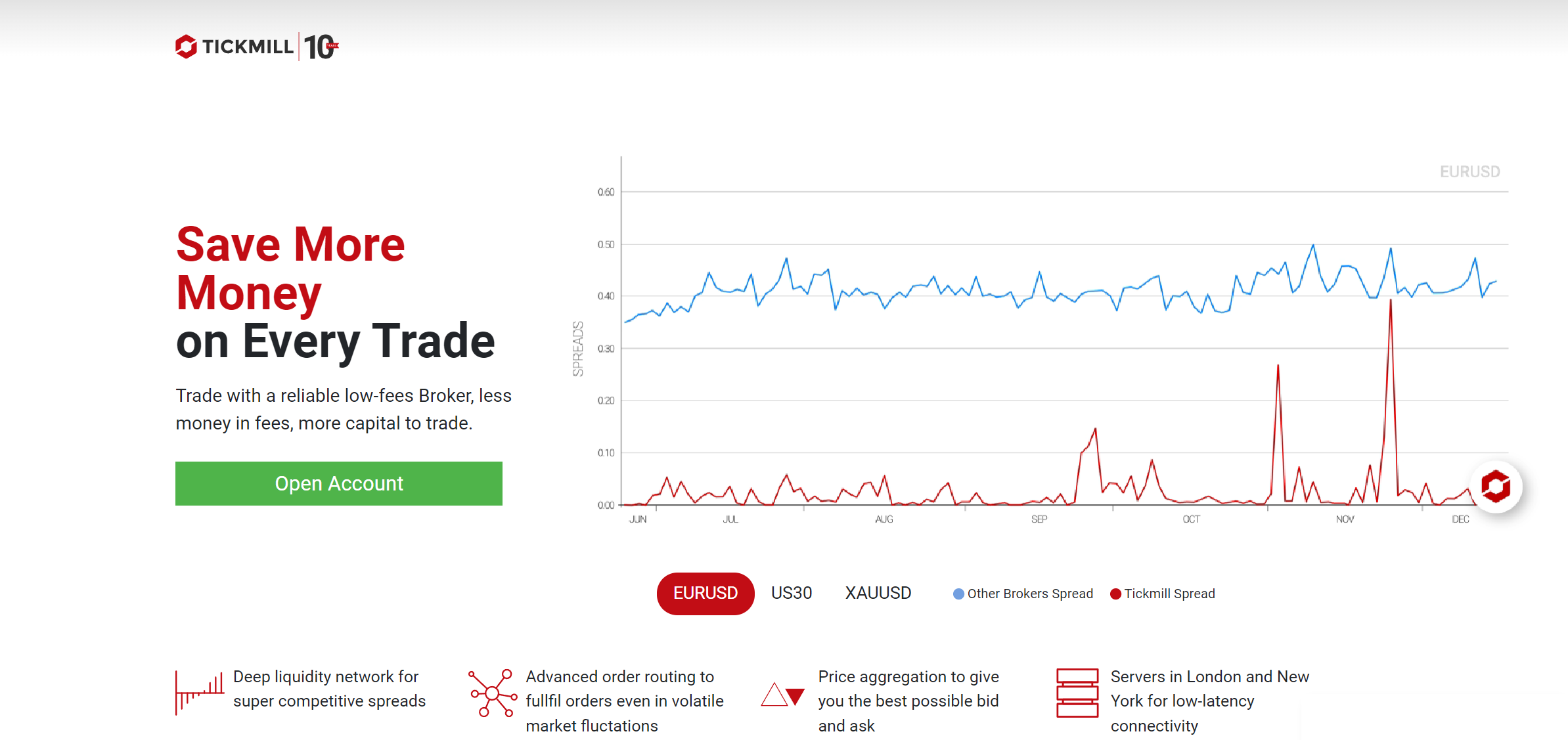

Tickmill

Tickmill is yet another quality broker that offers two raw spread accounts alongside a standard account. The standard account has spreads from 1.6 pips for major currency pairs with no commissions charged. In contrast, the two raw spread accounts offer 0.0 pips plus a commission. The commission is $3 per side per lot on the Raw account and $3.5 per side per lot on the Tickmill Trader Raw account. The starting deposit o open either account on Tickmill is $100.

Tickmill is also a well-regulated broker in multiple jurisdictions. This broker operates under the regulation of the FCA, the CySEC, the ASIC, and the FSA in Seychelles. Multiple regulations are always a good sign on a broker site.

To trade on this broker site, people have access to various trading platforms. These include MetaTrader 4, MetaTrader 5, and mobile apps. These platforms allow traders to access various global markets including forex, stock indices, metals, bonds, commodities, and cryptocurrencies.

Final Thoughts

Both Raw Spread and Standard accounts have their merits and demerits to traders. Their various key features make them suitable for different trader profiles. Eventually, the best choice depends on a trader’s individual trading needs and preferences. It’s essential to consider factors such as trading volume, frequency, experience level, and capital when deciding which account type to use.

Additionally, it’s always a good idea to compare the conditions offered by different brokers. In this article, we featured several well-regarded brokers that offer both standard and raw spread accounts. However, this is not an exhaustive list. We encourage each trader to do their own thorough research to find the best account and forex broker for them.

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.