| This material is not intended for viewers from the UK and EEA countries. |

Octa has established itself as a prominent player in the online trading industry. It offers a diverse range of financial instruments and trading platforms to a global clientele. According to the company, Octa has over 40 million registered accounts, making it one of the largest brokers globally. Importantly, Octa offers its traders a variety of trading accounts to fit different trader profiles.

Choosing the right account type is a crucial step for any trader, as it can directly impact trading conditions, available instruments, and overall trading experience. In this review, we will explore Octa’s account types, focusing on their features and suitability for different trading strategies.

Understanding the Basics

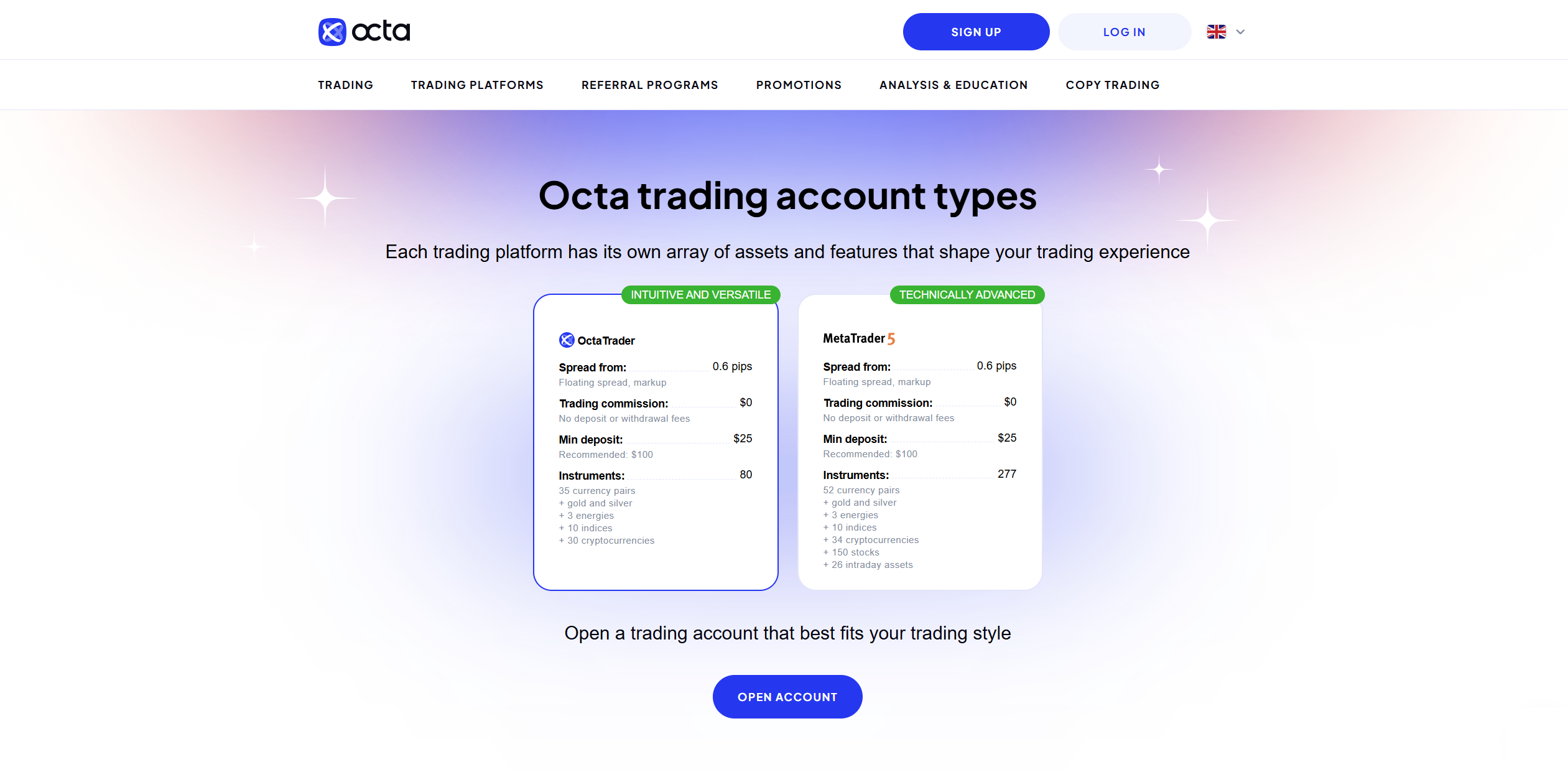

Before diving into the specifics of each account type, it’s essential to understand the underlying factors that differentiate them. Octa primarily distinguishes its accounts based on the trading platform used. At the moment, Octa offers two trading platforms from which to choose, OctaTrader and MetaTrader 5.

OctaTrader – This is Octa’s proprietary platform, designed with a focus on simplicity and ease of use, particularly for beginner traders. It adopts charting technology by TradingView and offers a unique feature called Space which is a feed with trading ideas and lessons by Octa experts.

MetaTrader 5 (MT5) – MetaTrader 5 (MT5) is a multi-asset trading platform offering advanced tools for technical analysis, algorithmic trading, and strategy testing. It supports multiple order types, depth of market (DOM), and over 80 indicators, enabling traders to make informed decisions. MT5’s flexible interface and multi-asset support make it ideal for diverse trading strategies.

Each platform caters to different trader profiles and preferences, influencing the account features associated with it. Here are the accounts offered by Octa.

Octa Account Types

OctaTrader Account

The OctaTrader account is available through Octa’s proprietary trading platform, OctaTrader. This account offers competitively low spreads from as low as 0.6 pips with no commissions nor spread markups. It has a low minimum deposit of just $25 and supports the trading of a variety of market products. On this account, investors can trade CFDs on forex, metals, indices, energies, and cryptocurrencies. This account does not offer access to stocks and intraday assets.

The trading platform on this account supports various trading strategies including scalping and hedging. However, this account does not support the use of EAs. Also, the maximum order size supported on this account is 50 lots. It features a 50% deposit bonus for traders.

Who Is It For?

The OctaTrader account is ideal for traders who prioritise simplicity and mobile accessibility. Because the OctaTrader platform is made to streamline the trading process, this account fits all levels of traders. Both beginners and experienced traders can be comfortable on this account. Its simplicity makes it a popular choice among most traders.

MetaTrader 5 (MT5) Account

The MT4 account is accessible through the MetaTrader 5 platform. Like the OctaTrader account, the MetaTrader 5 account also has spreads from as low as 0.6 pips with no commissions and no spread widening. The minimum deposit is also the same at just $25. Additionally, it offers traders a 50% deposit bonus.

However, this account gives traders access to more market products than the OctaTrader account. It offers access to CFDs on forex, metals, energies, indices, cryptocurrencies, stocks, and intraday assets. Additionally, this account allows for the use of EAs for automated trading. This makes it easy for traders to adopt strategies such as high-frequency trading. Further, the maximum order size on this account is bigger at 500 lots.

Who Is It For?

The MT5 account is designed for more experienced traders who require advanced trading tools and access to a broader range of instruments. It is also suitable for those interested in stock trading and utilising high-frequency trading strategies. Nonetheless, MetaTrader 5 is a popular trading platform and many traders will prefer to use this account regardless of their trading strategies.

Does Octa have Islamic Accounts?

Muslim traders require special trading conditions to align their experience with the religious demands of Islam. To make forex trading Halal, Muslim traders must ensure they follow Sharia law that prohibits them from paying overnight interest charges (swap fees). To address these demands, Octa has designed its trading site to be 100% halal in relation to the three key aspects of Sharia-compliant trading. These include no interest, no gambling, and no excessive risk. Notably, all of Octa’s trading accounts are designed to be 100% halal by default. This means that Muslim traders can simply choose one account they like and start trading right away.

Choosing the Right Account

Selecting the appropriate Octa account type depends on your individual trading needs and preferences. Consider the following factors:

- Trading Experience – Beginners may find the OctaTrader account more suitable due to its simplicity. Experienced traders who require advanced tools and features may prefer the MT5 account.

- Trading Style – Day traders may favour OctaTrader for its simplicity, while those seeking a broader range of assets might find the MT5 account more appealing. Additionally, traders can choose an account that supports copy trading.

- Trading Platform Preference – If you have a strong preference for a specific platform, your choice is straightforward. Simply choose the account that is on your preferred platform.

- Instruments – If you are interested in trading stocks, the MT5 account is the only option.

How to Open An Octa Trading Account

To open your first Octa trading account, simply follow these instructions:

Sign up – First, create an account and customise it by specifying whether it’s a real or demo account.

Deposit – The next step is to make your first deposit. Remember that the minimum deposit is $25 but it may vary depending on the payment option you choose to use.

Verify – The next step is to verify your account. You will do this by uploading your ID for review. The process usually takes about 1 to 2 business hours. Once the Octa team confirms your identity, you can start withdrawing funds from your trading account.

Trade – That’s it. Once you complete the steps above, then your account is ready to start placing trades and performing other operations. On the bright side, you can always open more trading accounts on different trading platforms for free.

Conclusion

Traders usually offer several accounts to cater to different trading styles and trader preferences. By understanding the features, advantages, and disadvantages of each account type, you can choose the one that best aligns with your trading goals and preferences.

Fortunately, Octa prioritises simplicity when it comes to account options. You can simply consider the trading platform you prefer and the instruments you would like to trade. Once you have that figured out then the account that best meets your needs will be straightforward. If you are not sure, then start with a demo account to evaluate the features and test the platform.