Gold has a long history and connection to the financial world. It has long been viewed as a symbol of wealth and, importantly, a safe-haven asset. A lot of investors use gold as a hedge against inflation and economic uncertainties. However, trading gold requires a deep understanding of the market, strategies, and risk management.

For beginners and even experienced traders, a gold trading demo account is an invaluable tool. It comes in handy in learning the dynamics involved in trading and testing out strategies without risking real money. This article will explore the concept of a gold trading demo account, its benefits, and where you can practice trading gold effectively.

What is a Gold Trading Demo Account?

A gold trading demo account is a simulated trading environment provided by brokers. It offers trading conditions that mimic real-market conditions for traders to practice. This account provides traders with virtual funds to practice trading gold without risking their actual capital. Demo accounts offer access to a range of trading tools, charting platforms, and market data. This allows investors to experiment with different strategies, analyse market trends, and gain experience with the trading platform before committing to real funds.

To have the best experience with a gold trading demo account, traders need to use reliable forex brokers that offer demo accounts. Choosing the right broker requires traders to consider a variety of factors.

How to Choose a Gold Trading Demo Account

When selecting a broker for your demo account, it’s crucial to consider the following factors:

- Regulation – Above everything, it is important to choose a reputable broker with a strong track record and a regulatory license. Brokers with regulations from top-tier organisations usually offer the best trading conditions.

- Trading Platform – it is also important to select a broker that offers a user-friendly and feature-rich trading platform that suits your needs.

- Market Products – Ensure that the broker offers a wide range of trading instruments to allow for diversification.

- Trading Fees – The demo account should mirror real market conditions, including spreads. It is important to pick among brokers that offer low spreads on gold for the best experience.

- Educational Resources – Because this is a learning environment, picking a broker that offers educational material is crucial to enhancing your trading knowledge and skills.

With these factors in mind, let’s take a look at some of the best forex brokers that offer demo accounts to traders.

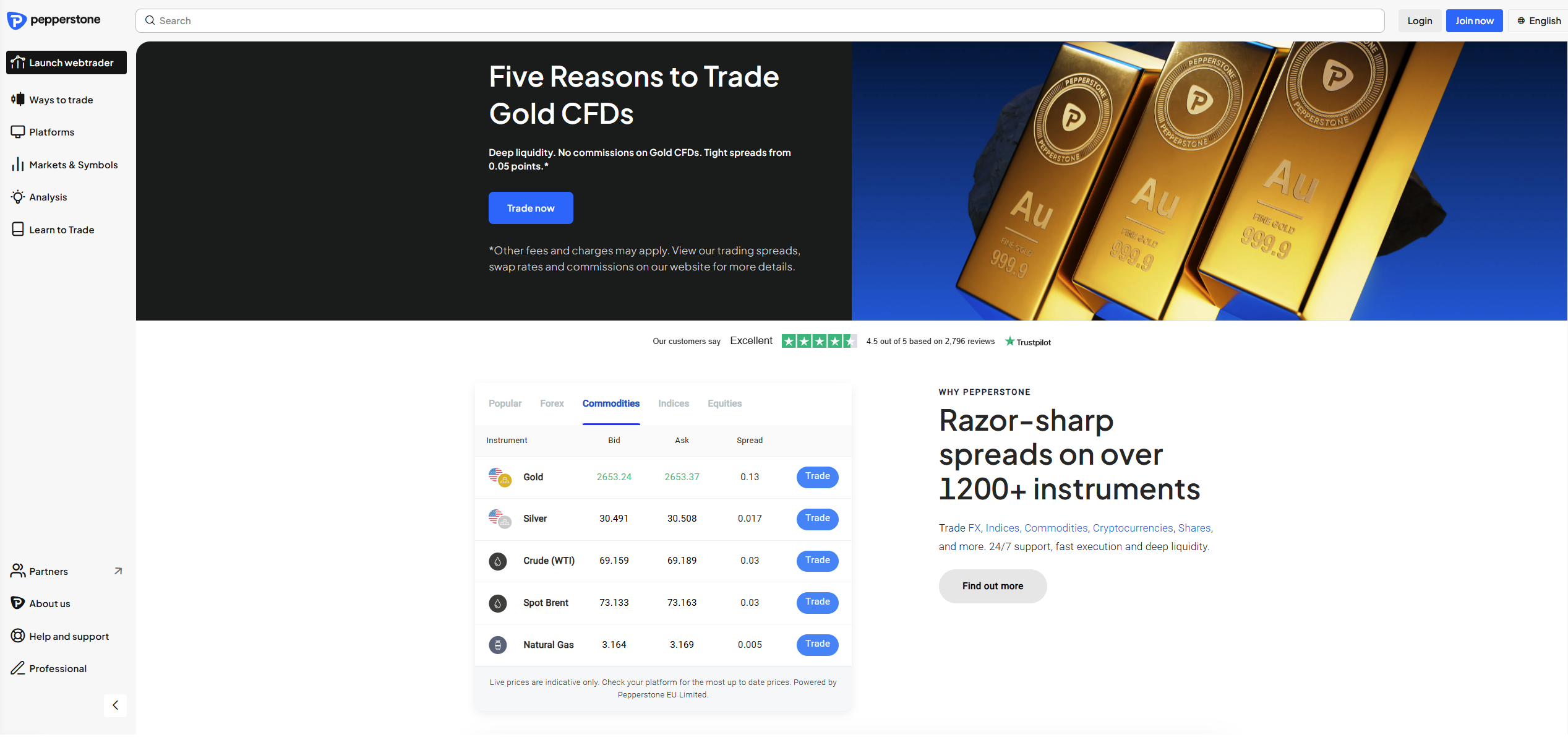

Pepperstone

Pepperstone is a highly reputable broker that offers a gold trading demo account. The demo account provided by Pepperstone comes with 50,000 virtual funds in any account currency supported by the broker. Notably, these accounts can be created in either standard or razor set-ups but there is no swap-free demo account.

Notably, MT4 and MT5 accounts expire after 60 days while TradingView and cTrader demo accounts do not expire. However, traders can set their MT4/Mt5 accounts to non-expiry by opening and funding a live account. Still, a non-active (account with no login) will expire after 90 days. If you have a live trading account, you can open up to 10 different demo accounts. Traders without a live account can only open up to 5 demo accounts.

Access to multiple demo accounts means that traders can practice different strategies of trading gold on various accounts simultaneously. Additionally, Pepperstone provides gold CFDs with some of the lowest spreads. The XAUUSD pair features a minimum spread of 0.05 points and an average of 0.19 points on both the standard and the razor account. Gold is also available to trade against other currencies including the Euro, the Australian Dollar, and the Japanese Yen, among others. Pepperstone also offers a wide range of educational resources for traders.

Further, Pepperstone offers a deep collection of trading instruments alongside gold CFDs. These include CFDs on forex, indices, commodities, cryptocurrencies, and ETFs. Finally, this broker operates under the regulation of the FCA in the UK, the ASIC in Australia, the CySEC in Cyprus, the CMA in Kenya, and the DFSA in the DIFC, among others. Overall, Pepperstone is a great option for traders seeking a reliable and regulated broker to practice gold trading with a demo account.

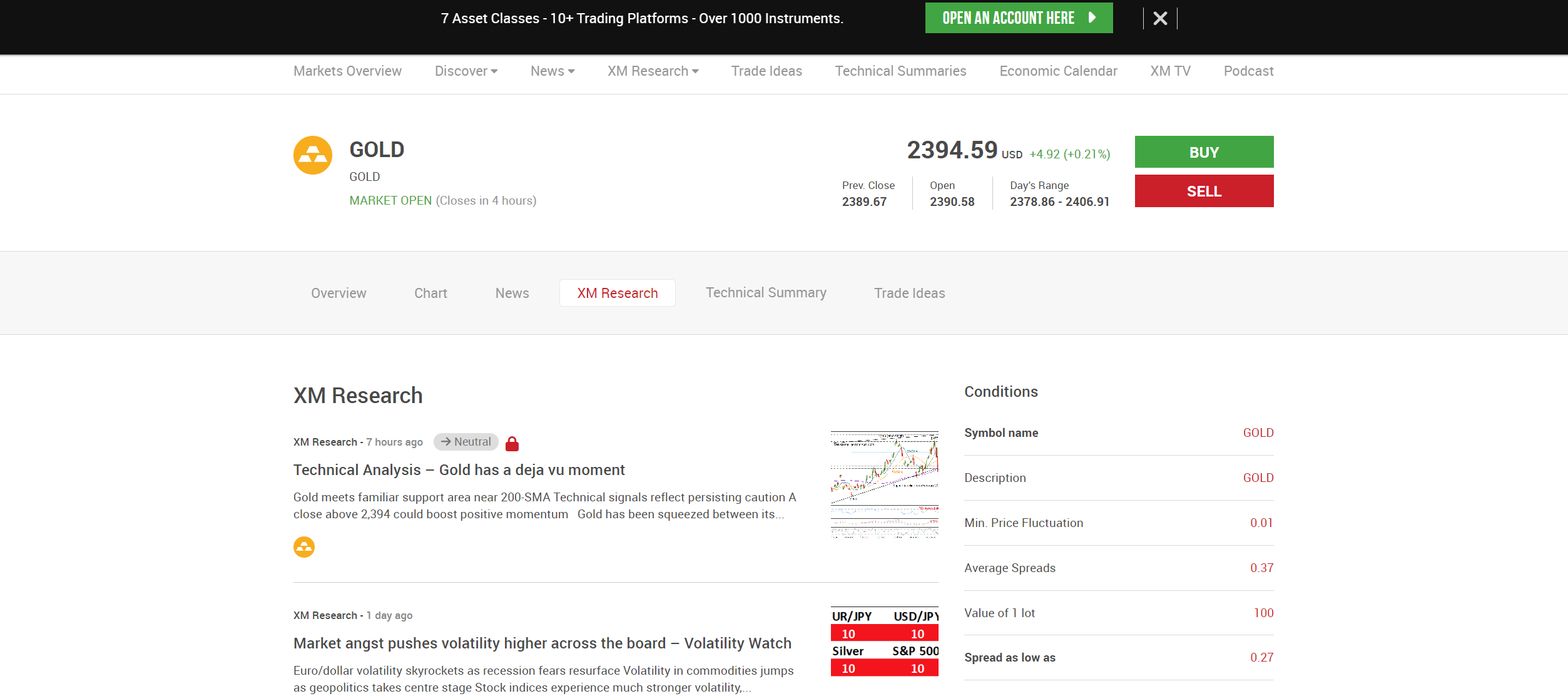

XM

XM is another well-known broker that provides an excellent gold trading demo account. The broker does reveal how much virtual funds are in the account upfront. However, it allows traders to reset their account balances as soon as they open the account. The XM demo account is fully functional and allows traders to experience the XM trading environment without risking real funds. XM’s demo account expires after 90 days of no login.

XM offers competitive spreads on gold, making it an attractive option for traders looking to minimise costs. The spreads on the gold CFD (XAUUSD) start from a low of 2.7 pips (0.27 points) and average at 3.7 pips. Gold is also available to trade against the Euro. The available trading platforms are MetaTrader 4, MetaTrader 5, and XM’s Trading Point app. Further, XM provides a variety of educational resources, including webinars, video tutorials, and market analysis.

In addition to gold, XM offers a wide range of trading instruments. These include CFDs on forex, indices, energies, shares, cryptocurrencies, and other precious metals. This diversity allows traders to explore different markets and build a well-rounded trading portfolio. On regulations, this broker operates under the supervision of the ASIC, the CySEC, and the FSC, among others.

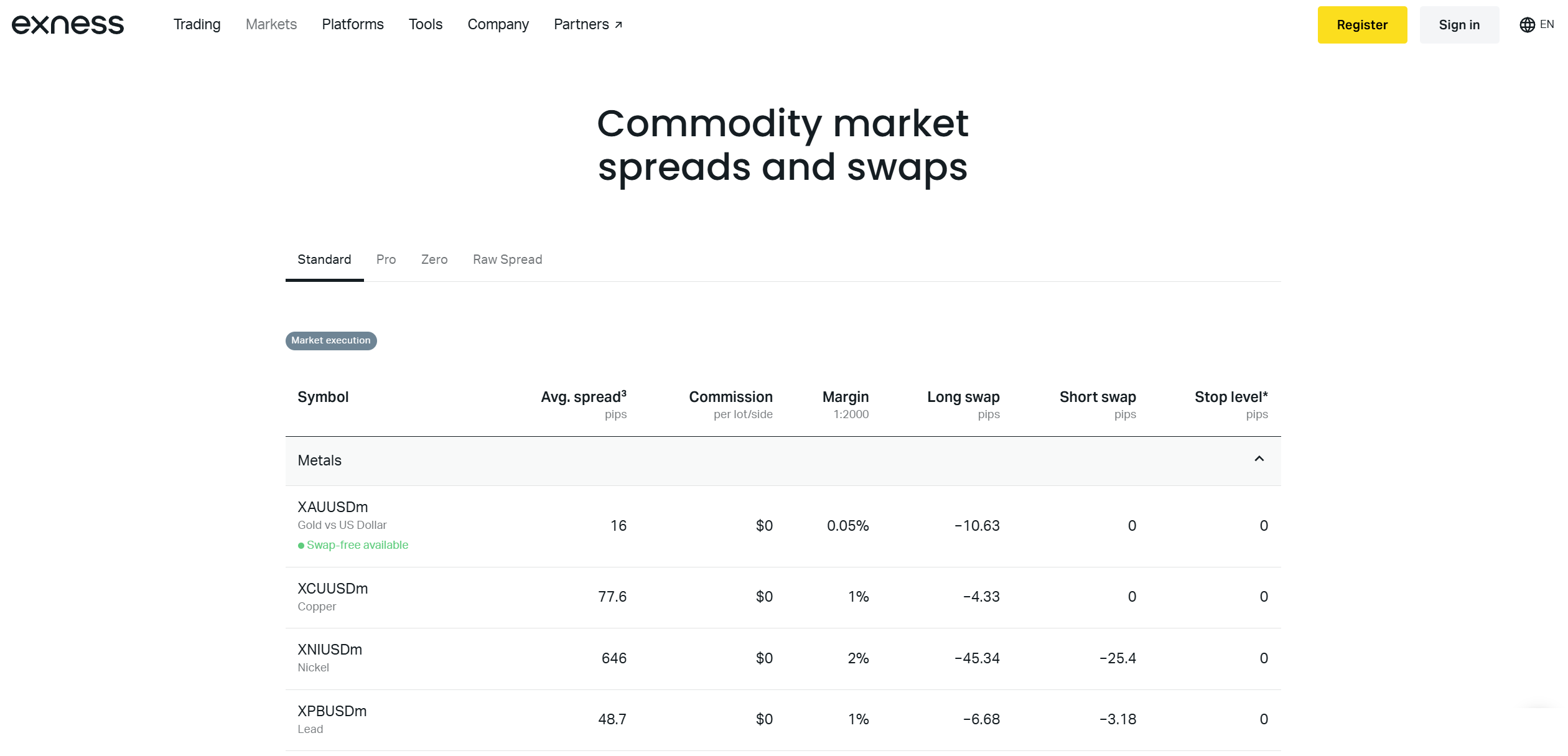

Exness

Exness is a top-tier broker that offers a robust gold trading demo account. The broker provides a demo account with a virtual balance of $10,000. This allows investors to practice their trading, sharpening their skills and strategies. Additionally, it allows them to master Exness’ unique tools without financial risk. There is an extensive education section on Exness.

Exness demo accounts have an expiry date depending on the trading platform. MT4 demo accounts are deleted after 180 days of inactivity. In contrast, MT5 demo accounts are deleted after 21 days of inactivity. The broker does not mention how long it takes for an Exness Terminal demo account to expire. Unfortunately, demo accounts cannot be reactivated once they are deleted.

Further, Exness offers some of the most competitive spreads on gold CFDs, making it an attractive option for traders. When trading gold against the US Dollar, the average spread is 16 pips (1.6 points) on both the standard and standard cent accounts with no commission charged. In comparison, the Pro account offers lower spreads, averaging 11.2 pips with no commission.

Meanwhile, the raw spread account offers an average spread of 3.7 pips but also charges a commission of $3.5 per side per low. Finally, the zero account provides an average spread of 0.0 pips with a commission of $5.5 per side per lot. Importantly, Exness does not charge any swap fees on gold on any of its accounts making it a perfect option for investors who do not wish to worry about how long they are staying in their gold position.

On regulations, Exness operates under the supervision of several reputable authorities. These include the FCA in the UK, CySEC in Cyprus, the FSCA in South Africa, and the CMA in Kenya, among others. While Exness accepts traders from most countries around the world, they do not accept retail clients from the UK and EEA countries, among others.

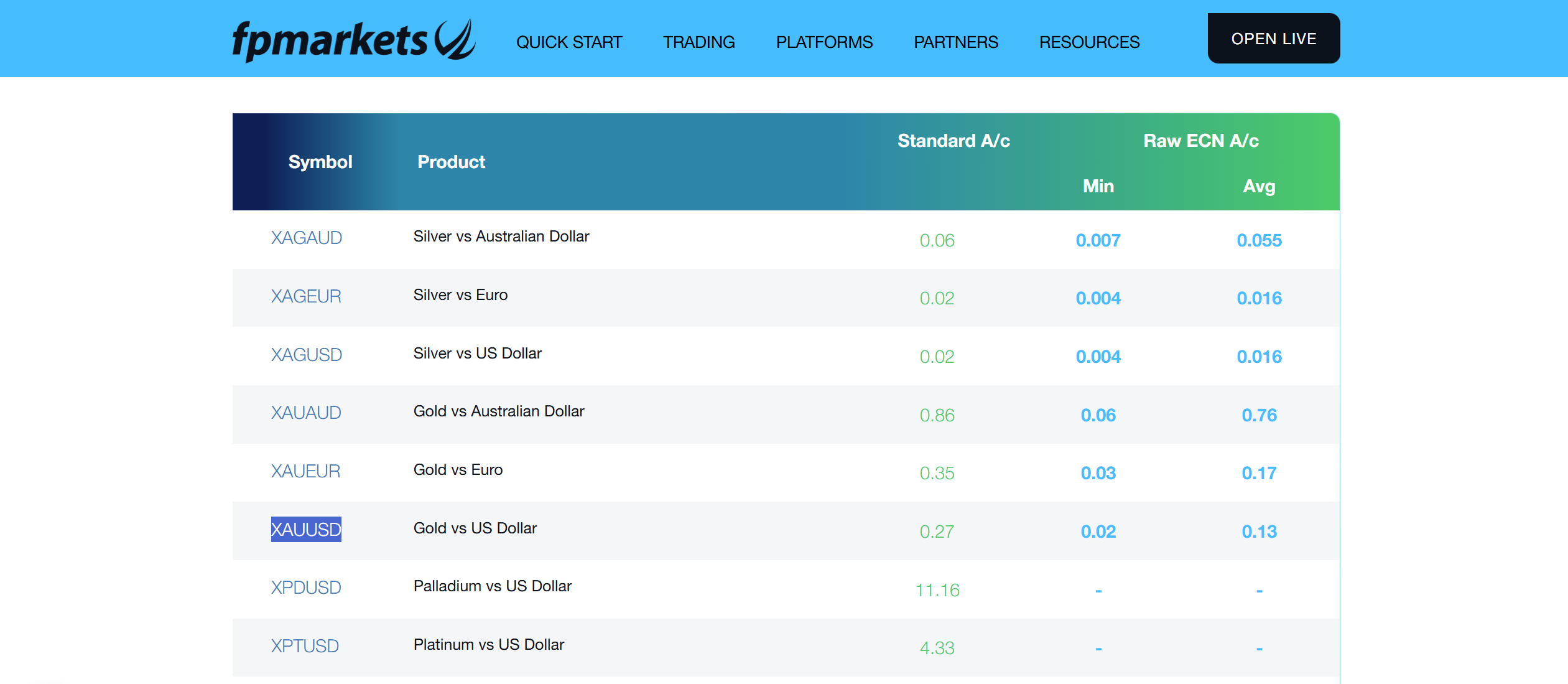

FP Markets

FP Markets is a well-regarded broker that offers a gold trading demo account. On this broker site, traders can practice gold trading in a virtual demo account loaded with a virtual balance of $100,000. Technically, the demo account has the same functionality as a live trading environment. Important to note, that if a trader does not log into their demo account for more than 30 days, their demo account will expire. However, if you stay active and log in from time to time, the demo account will not expire. Further, the trader is free to create a new demo account if they wish. An extensive educational section on FP Markets is available to traders.

The spreads and conditions featured on this account try to mimic real market conditions as closely as possible. Luckily, FP Markets is one of the lowest gold spreads brokers in the world. At the time of writing this, the XAUUSD (gold against the US Dollar) pair is trading on the FP Markets broker site with a minimum spread of 0.02 points and an average of 0.13 points. Gold is also available to trade against the Euro, the British Pound, and the Australian Dollar, among other currencies. Please note that gold is available on this broker site as a CFD.

On another note, FP Markets supplies traders with a deep collection of market products, which are also available on the demo account. Particularly, this broker supports the trading of CFDs on forex, cryptocurrencies, stocks, indices, commodities, and ETFs. This makes FP Markets a great option for traders looking to diversify their portfolios. The trading platforms available to use include MT4, MT5, cTrader, and TradingView.

On another good note, FP Markets stands out for its extensive regulatory background. This broker operates under the supervision of the CySEC in Cyprus, the ASIC in Australia, the FSCA in South Africa, and the CMA in Kenya, among others.

HFM

HFM is another one of the top brokers offering a gold trading demo account. This account is available on MT4, MT5, and the broker’s WebTrader and comes with a $100,000 balance in virtual funds. This is enough for traders to practice different trading strategies. For example, some traders can practice scalping of gold on this demo account. The demo account provided by HFM is designed to replicate real trading conditions.

HFM is known for offering competitive spreads on gold trading, making it a preferred choice for many traders. The spreads on gold CFDs (XAUUSD) start from as low as 0.25 points on both the premium and the cent account. In contrast, the pro account features spreads as low as 0.16 points. In places where the top-up bonus account is available, the spread is from as low as 0.26 points. Finally, the zero account features a spread starting at just 0.03 points for the XAUUSD pair plus a commission of $7 per side per lot (100 ounces). Gold is also available to trade against the Euro. HFM provides an extensive range of educational resources, including webinars, market analysis, and trading guides.

In addition to gold, HFM offers a wide range of trading instruments. In total, traders have access to over 1,000 assets which include CFDs on forex, energies, indices, stocks, commodities, bonds, ETFs, and cryptocurrencies. The broker is well-regulated, operating under the supervision of the CySEC, the FCA, the DFSA, the CMA, and the FSCA.

Octa

Octa is another reliable broker that provides a gold trading demo account. Traders can access virtual funds to practice gold trading using the broker’s intuitive platforms. While the broker does not specify the amount of virtual funds, it allows traders to keep their demo accounts with no expiry. This gives traders enough time to practice trading gold without risking real money. Better yet, this demo account provides real market data and pricing.

Octa is known for offering competitive spreads on gold trading. Traders can access gold as a CFD against the USD (XAUUSD) with an average spread of 2.0 points with no commission paid. Additionally, all of Octa’s accounts are swap-free, making it ideal for traders who want to hold positions for extended periods of time.

In addition to gold, traders have access to a diverse range of financial instruments. These include shares, as well as CFDs on currency pairs, stocks, indices, commodities, and cryptocurrencies. Octa provides access to the industry-leading MetaTrader 4 and MetaTrader 5 platforms, along with its proprietary OctaTrader platform.

When it comes to regulation, Octa is licensed and overseen by multiple reputable authorities. These include the CySEC and the FSCA in South Africa, among others. While Octa accepts traders from most countries around the world, they do not accept retail clients from the UK and EEA countries, among others.

Benefits of Using a Gold Trading Demo Account

- Risk-Free Learning – As mentioned earlier, the most significant benefit of a demo account is the ability to learn and practice trading without risking your capital. This allows you to experiment with different trading strategies, test your risk management techniques, and develop a solid understanding of market dynamics.

- Familiarisation with Trading Platforms – Trading platforms can be complex, especially for those new to trading. A demo account provides traders the opportunity to familiarise themselves with the platform’s features, tools, and functionalities.

- Emotional Management – By practising in a simulated environment, traders can learn to manage emotions like fear and greed, which can significantly impact trading decisions.

- Building Confidence – Trading can be intimidating, especially when real money is on the line. A demo account helps build confidence by allowing traders to practice and refine their skills in a risk-free environment.

Closing Remarks

A gold trading demo account is an essential tool for anyone looking to trade gold. It provides a risk-free environment to practice trading, test strategies, and familiarise yourself with trading platforms. Overall, a demo account can help traders of all levels build confidence, refine their skills, and prepare for live trading.

Fortunately, there are numerous brokers that offer gold trading demo accounts, each with its own set of features. It is important for all traders to consider their own individual needs before selecting a broker to partner with in their trading. Remember, trading gold, like any other financial instrument, carries a lot of risk. It requires a combination of requires patience, discipline, and continuous learning.