In forex trading, there are a lot of incentives that brokers use to attract traders to their trading sites. One of the most popular and attractive incentives that brokers offer is a deposit bonus. A deposit bonus can provide additional funds to traders and allow them to increase their position sizes. It also allows investors to explore market opportunities with relatively reduced personal risk.

Understandably, deposit bonus brokers are popular among traders. However, with hundreds of brokers offering this feature, choosing the right one can be daunting. In this detailed review, we are going to be looking at some of the best forex brokers with deposit bonuses, exploring how the bonuses are set up and the unique features of the brokers. Let’s begin.

Understanding Deposit Bonuses

A forex deposit bonus is a promotional offer from a broker, where they credit a trader’s account with a bonus that is a percentage of their deposit. For example, a 50% deposit bonus on a $100 deposit would give the trader an additional $50. This would result in a total trading capital of $150. Deposit bonuses can come in various forms:

- Percentage-Based Deposit Bonus – This is the most common type of deposit bonus offered by forex brokers. The broker offers a percentage of the deposited amount as a bonus.

- Fixed Amount Deposit Bonus – In this type of bonus, the broker offers a fixed amount of bonus funds regardless of the deposit amount. Of course, some other terms and conditions may apply.

- Tiered Deposit Bonus – Tiered deposit bonuses offer increasing bonus amounts based on the deposit amount (tier). It can also be based on trading volume.

These are generally the most popular deposit bonuses offered by forex brokers.

How to Select the Right Forex Broker with a Deposit Bonus

While deposit bonuses can be an attractive feature for traders, they should not be the sole reason for selecting a forex broker. It’s essential to evaluate several factors to ensure that the broker offers quality services. Traders should consider:

- Regulatory compliance – Regulation is the most critical factor to consider when selecting a forex broker. Ensure the broker you choose is regulated by a reputable financial authority like the DFSA, the CMA, or the FSCA, among others.

- Terms and Conditions of the Deposit Bonus – Deposit bonuses often come with specific terms and conditions that traders must understand before accepting the offer. Some withdrawal terms can be very restrictive and it is good to be aware beforehand.

- Trading Conditions – Evaluate the broker’s spreads, commissions, and execution speed. A large bonus is meaningless if the trading conditions are unfavourable.

- Trading Platforms and Tools – The trading platform is your primary tool for executing trades, analysing the market, and managing your account. Choose a broker that offers a user-friendly and reliable trading platform.

Using the criteria above, let’s take a look at some of the best forex brokers with deposit bonuses.

HFM

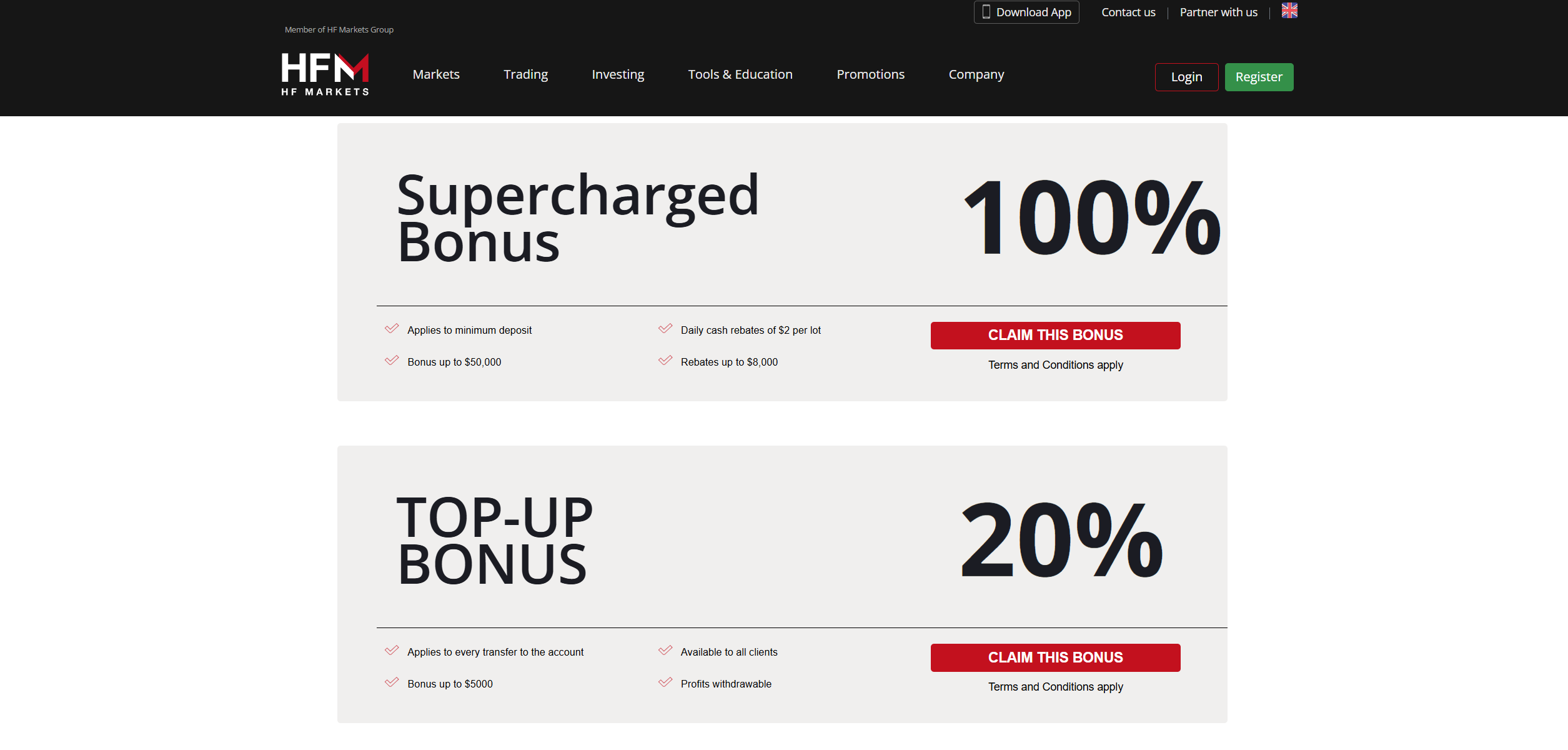

HFM is a globally recognised forex broker that has been in operation since 2010. This broker is known for the attractive bonuses it offers to traders. First, HFM offers a 100% Supercharged Bonus on deposits, which essentially doubles the deposit a trader makes. This deposit scheme applies to any deposits from $10 and above. However, there is a maximum cumulative deposit amount that a trader can earn which is $50,000.

On another note, this deposit bonus comes with one more benefit. It also offers daily rebates of $2 per lot, up to a maximum of $8,000. As such, it combines two bonus programmes from the company: the 100% SuperCharged Bonus Credits and SuperCharged Rebates. Interestingly, any withdrawal that a trader makes from their account will result in a reduction of their supercharged bonus amount on a 1:1 basis. This applies to profits, rebates, and deposits made by the trader.

Another deposit bonus that HFM offers to traders is the top-up deposit bonus. This bonus is usually 20% but can range from a modest 10% to a substantial 100%, providing traders with flexibility when claiming this incentive. The maximum bonus amount a trader can claim ranges from $100 to $5,000 depending on the specific bonus. While the top-up bonus itself cannot be withdrawn, any profits earned from trading with the bonus can be withdrawn. However, any withdrawal from the trading account will result in a reduction of the bonus proportional to the withdrawal amount. This bonus can only be applied to a Top-up Bonus account.

HFM’s Key Features

HFM is popular for its attractive trading conditions. It offers low spreads from as low as 0.2 pips on its pro-plus account. The broker also offers a zero spread account with spreads from 0.0 pips plus a commission of $3 per side per lot. There are a variety of account types to fit different trader profiles on HFM. The Top-up Bonus account features spreads from 1.4 pips for major currency pairs with no commission charged.

Further, this broker offers a ton of market instruments for traders to invest in. This means that traders can use their deposit bonus to craft a rich diversified portfolio. Specifically, traders have access to CFDs on forex, energy, indices, stocks, metals, bonds, commodities, cryptocurrencies, and ETFs. To trade these assets, traders can use MT4, MT5, and the HFM Platform.

In terms of regulations, this broker is under the supervision of the FSCA in South Africa, the DFSA in Dubai, the CMA in Kenya and the FSC in Seychelles, among others.

XM

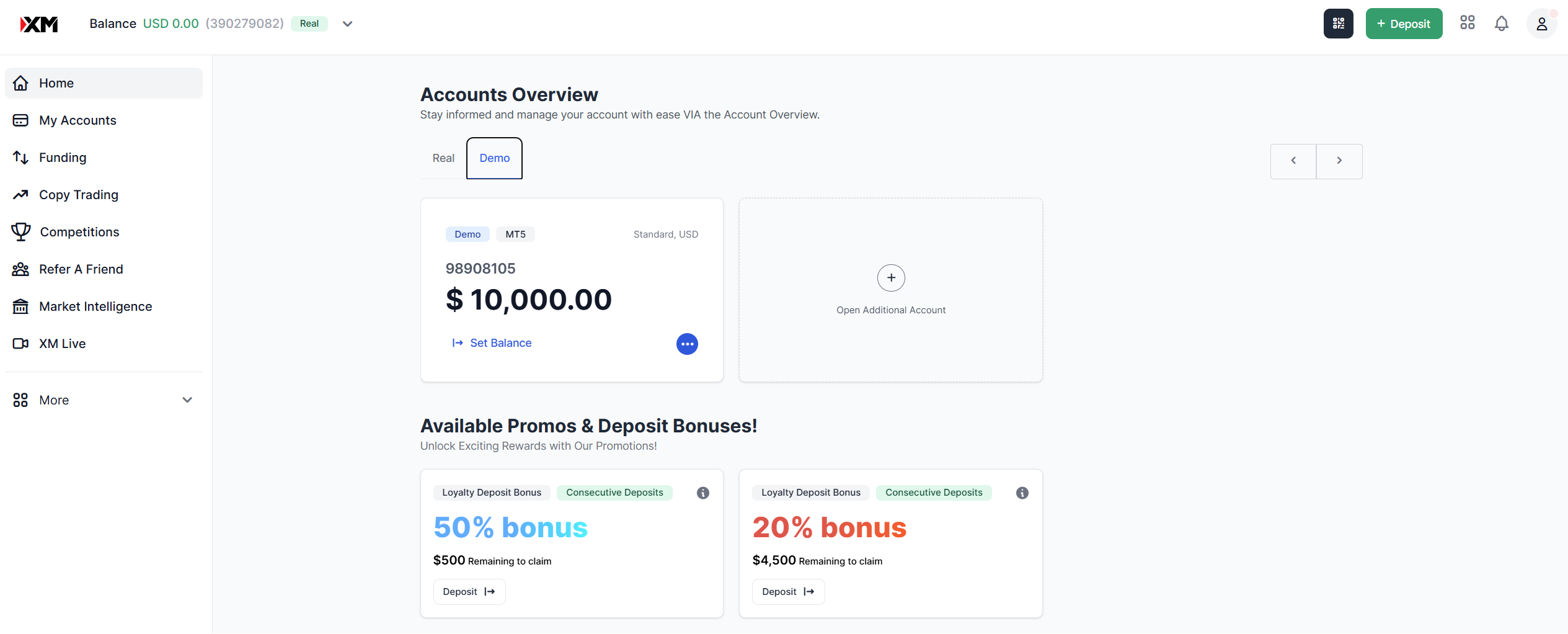

XM is another highly reputable forex broker known for its generous deposit bonus and trader-friendly conditions. This broker provides its traders with a two-tier deposit bonus. The first tier offers a 50% bonus on deposits up to $1,000, with a maximum bonus of $500 (when a trader receives up to $500). The second tier offers a 20% bonus on deposits exceeding $1,000, up to a maximum deposit of $23,500 (or a maximum bonus of $5,000). For deposits over $1,000, the first $1,000 receives the 50% bonus, and the remaining amount receives the 20% bonus.

This offer is available for the Standard and Shares accounts but does not apply to the XM Ultra Low account. As expected, traders cannot freely withdraw the deposit bonus from their accounts. However, any profits made from trading with the amount are free to withdraw. On another note, any withdrawal of funds from a client’s account will result in the removal of an amount of the deposit bonus proportional to the withdrawn funds. Just to mention, XM also offers a $30 no-deposit bonus to new traders. Terms and conditions also apply to the no-deposit bonus.

XM’s Key Features

XM is a globally recognised broker with a strong client base of over 15+ million clients from over 190 countries.

This broker offers a deep collection of over 1,000 different market products. These include CFDs on forex, equity indices, shares, cryptocurrencies, commodities, metals, stocks, and energies. There are a variety of advanced trading platforms investors can use on this broker site including MetaTrader 4, MetaTrader 5, and XM’s trading app.

In terms of trading fees, XM is very competitive. Its standard account offers a spread from 1.6 pips while the XM Ultra Low account has spreads from 0.8 pips. Both do not charge a commission.

Octa

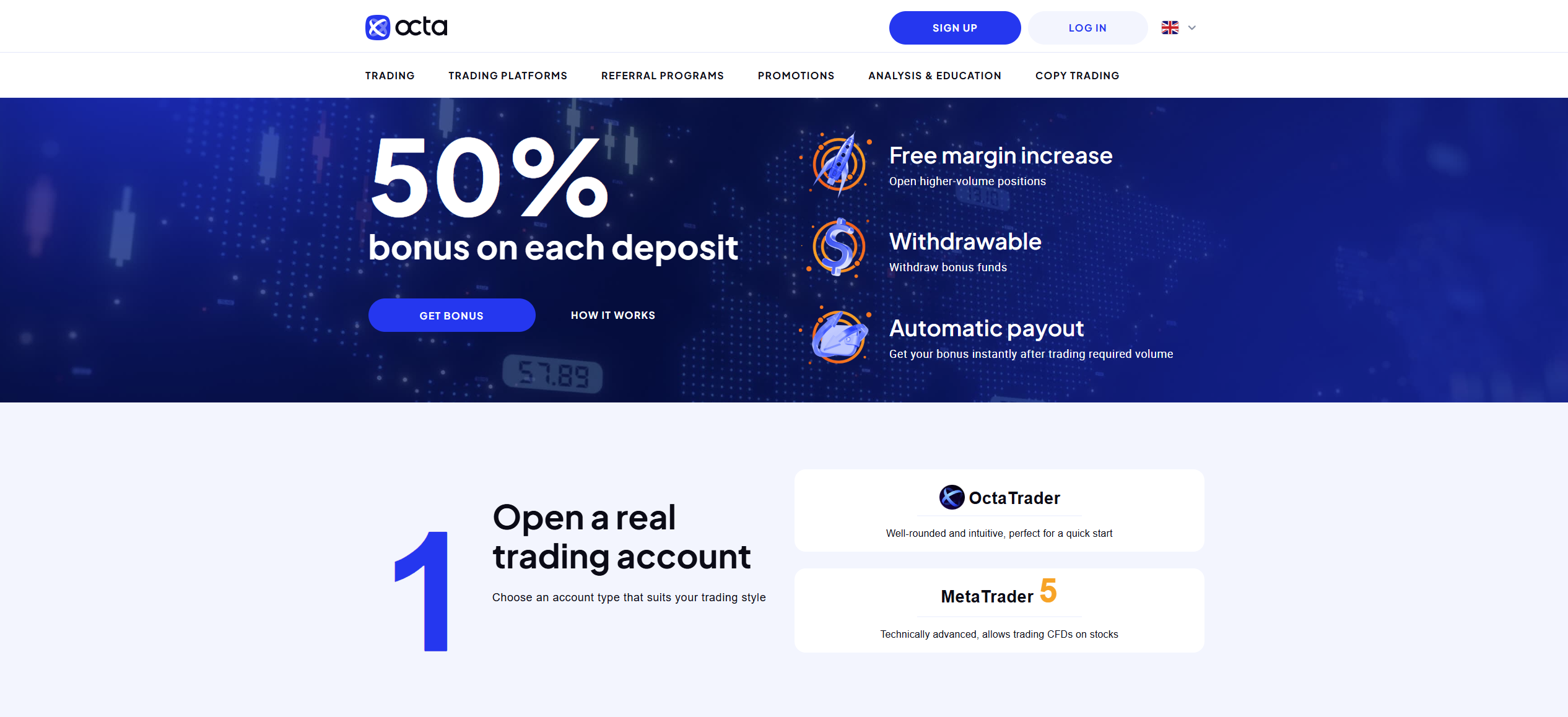

Octa is a well-established forex broker that has been providing trading services since 2011. This broker offers a 50% deposit bonus on deposits made by traders. This helps boost the trading capital of traders with additional funds proportional to their deposits.

To qualify for the 50% bonus, traders must follow three key steps. First, they need to open a real trading account and make a deposit. Next, they must trade a number of lots equal to half of their bonus amount. For instance, if a trader deposits $400, they would need to trade at least 100 lots to unlock their $200 bonus. As with other deposit bonuses, traders cannot withdraw this bonus directly from their accounts. However, profits from the deposit are free to withdraw.

Octa’s Key Features

Octa offers its traders a deep collection of market products, allowing them to diversify their investments. Specifically, this broker allows traders to speculate on CFDs on forex, cryptocurrencies, commodities, indices, and stocks. To trade these instruments, the broker avails three main trading platforms. These include MetaTrader 4, MetaTrader 5, and OctaTrader.

There are only two accounts available to use, both offering spreads from 0.6 pips for major currency pairs with no commission charged. Further, Octa is a regulated broker in a few jurisdictions. These include the FSCA in South Africa and the MISA in Mwali.

Libertex

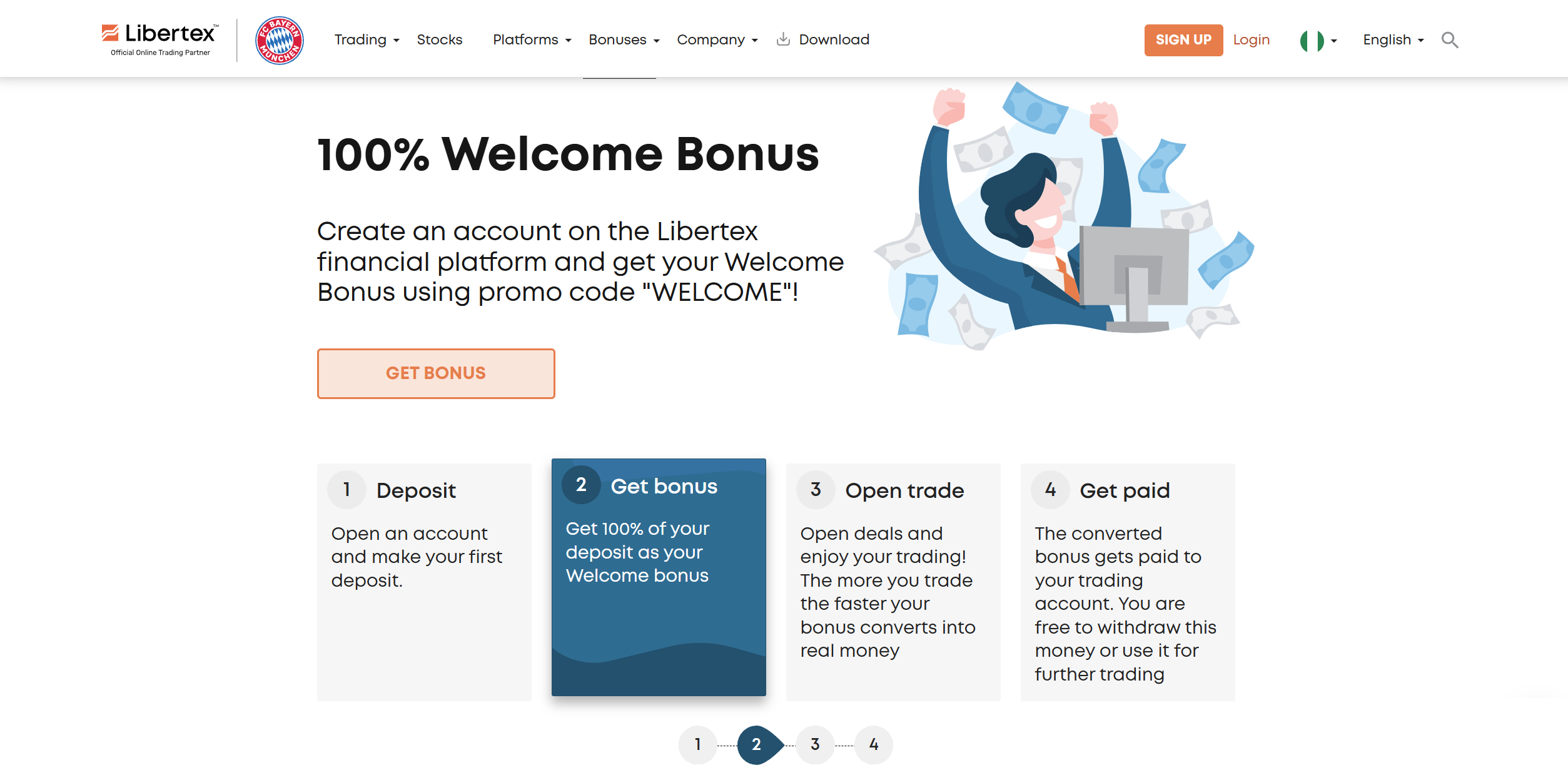

Libertex is a well-established forex broker that offers a deposit bonus to new traders. The broker provides a 100% deposit bonus, effectively doubling the initial trading capital. This bonus applies to first-time deposits and allows traders to take larger positions in the market. Interestingly, Libertex allows traders to withdraw this bonus if they wish. The minimum deposit eligible to get the deposit bonus is $100 and the maximum bonus amount a trader can receive is $10,000.

Libertex Deposit Bonus Terms And Conditions

It’s important to note that traders cannot directly access this 100% deposit bonus for withdrawal or trading. Instead, they must complete a redemption process, which involves engaging in trading activities. Each day at 21:00 UTC, Libertex calculates the total fees paid from trading and credits the trader’s account with 10% of these fees as part of the bonus. Traders can choose to withdraw this credited amount or use it for further trading. To fully convert the Welcome Bonus into fiat currency, the conversion process must be finalized within 30 days. Any portion of the bonus that remains unredeemed after this period will be forfeited by Libertex.

Libertex’s Key Features

Libertex offers a wide range of trading instruments, including CFDs on forex, indices, cryptocurrencies, stocks, oil, and gas. The broker provides competitive spreads depending on market conditions. It also charges a commission per trade. The commission for forex pairs is a low $7 per $100,000 traded. There are three trading platforms available to use including MetaTrader 4, MetaTrader 5, and the Libertex platform.

Skilling

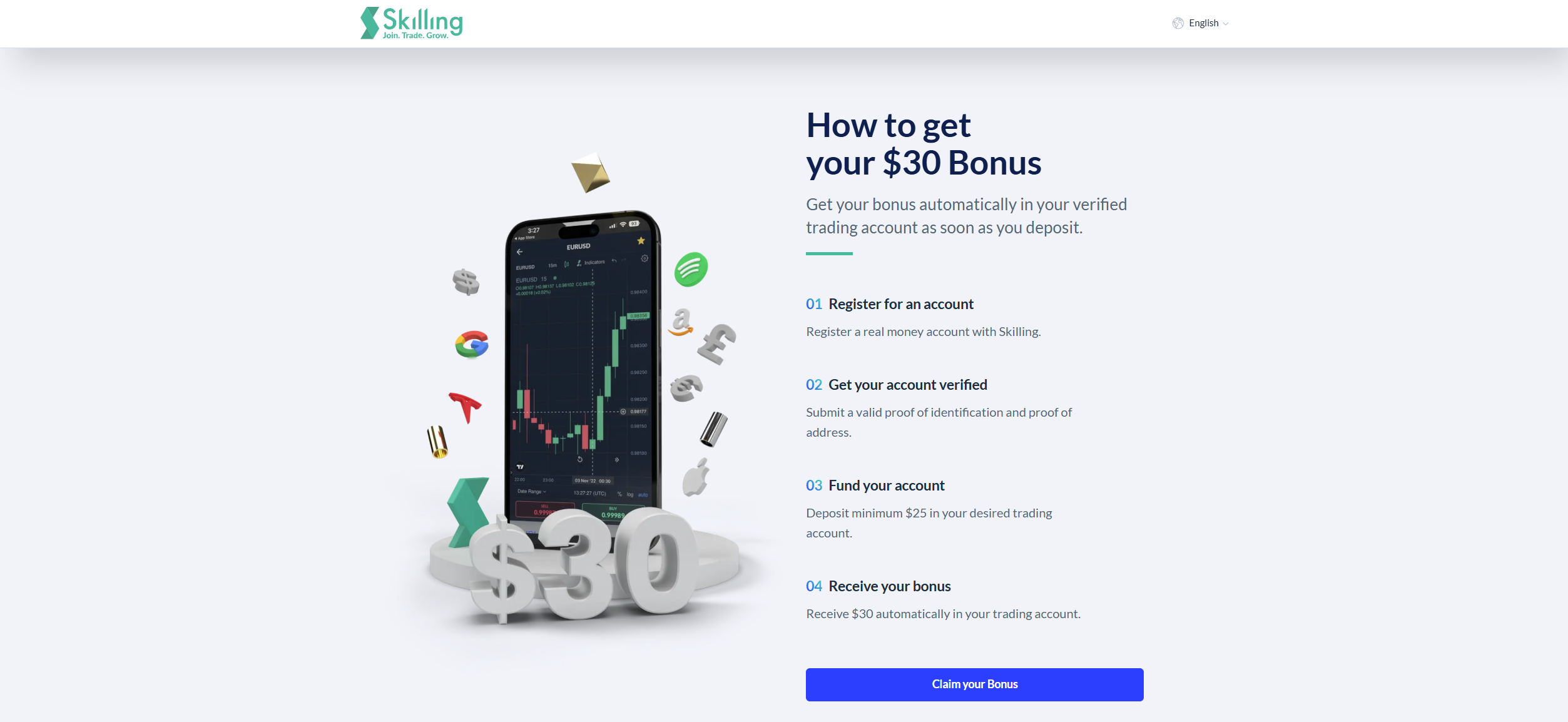

Skilling is a reputable Forex and CFDs broker that offers an attractive deposit bonus to traders. This broker provides a $30 deposit bonus to new clients after they make a deposit. When using an MT4 account, you have to deposit at least $30 to receive the $30 bonus.

In contrast, Skilling Trader and Skilling cTrader account holders can receive a $25 bonus when they deposit the minimum deposit of $25. Any amount more than $30 will receive a deposit bonus of $30. The deposit bonus is not withdrawable. However, the profits made from trading with it are. Notably, traders can lose the welcome deposit bonus if there is no trading activity in their account for 90 consecutive days.

Skilling’s Key Features

Skilling offers competitive trading conditions, including tight spreads from 0.1 pips on its Premium accounts (higher minimum deposit required). These accounts charge a commission of $3.5 per 100k traded. Skilling’s Standard accounts have spreads from 0.8 pips with no commission charged. There are three main trading platforms including Skilling Trader, Skilling cTrader, and Skilling MetaTrader 4, which all have ultra-fast trade execution. On another note, this broker offers access to diverse global markets including forex, shares, commodities, indices, and cryptocurrencies. Finally, this broker has regulation from the FSA in Seychelles.

Advantages of Deposit Bonuses

- Increased Trading Capital – The most obvious benefit of a deposit bonus is the increase in trading funds. This allows traders to open larger positions and potentially earn higher profits.

- Reduced Risk – Deposit bonuses can act as a buffer against losses. Since the bonus funds are not a trader’s the overall risk to their trading account is reduced.

- Incentive for New Traders – The bonus provides an opportunity to gain experience and build confidence without significant financial risk.

- Opportunity for Diversification – With more capital at a trader’s disposal, they can explore a wider range of trading strategies with reduced risk.

Disadvantages of Deposit Bonuses

- Withdrawal Restrictions – One of the most significant drawbacks of deposit bonuses is that the bonus funds themselves are often non-withdrawable.

- Limited Timeframes – Some deposit bonuses have expiration dates, meaning the bonus funds must be used within a specific period. If the timeframe is too short, traders may not have enough time to utilise the bonus effectively.

- Limited Account Types – Some deposit bonuses are only available for specific account types, which may not suit all traders.

Closing Remarks

Forex deposit bonuses can be a valuable tool for both new and experienced traders. They provide increased trading capital and opportunities to explore different trading strategies. Moreover, they generally reduce the risk involved in trading by a trader.

However, it’s crucial to choose a reputable broker with favourable trading conditions to effectively utilise a deposit bonus. Ensure the broker you choose has great regulation, low fees, advanced trading platforms and sensible terms and conditions on the bonus. Remember to prioritize responsible trading and focus on long-term growth in the forex market. The forex market still carries a lot of risks even with a deposit bonus.

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.