PayPal is one of the most widely recognised and trusted online payment systems globally. It allows individuals and businesses to send and receive money securely and efficiently. Today, PayPal operates in over 200 countries and supports multiple currencies, making it ideal for international transactions.

Understandably, PayPal has become one of the most popular payment methods on forex broker sites. There are now many brokers that support PayPal in funding accounts and withdrawing profits. In this article, we will explore some of the best forex brokers that accept PayPal, providing some insights into their features.

Factors to Consider When Choosing a PayPal Forex Broker

Before diving into specific brokers, it’s essential to understand the key factors to consider when making your selection:

- Regulation – Above everything, traders should always consider the regulatory status of a broker. They should ensure the broker they choose operates under the supervision of reputable authorities like the FCA, the CySEC, or the ASIC, among others.

- Trading Costs – It is very crucial to consider the trading costs involved on a broker site. Compare spreads, commissions, and other charges and pick the broker that helps maximise your profit potential.

- Trading Platforms – A robust and user-friendly trading platform is crucial for a seamless trading experience. Remember, financial markets are fast-paced and require a fast order execution platform.

- Trading Instruments – It is also important to consider the range of tradable assets offered by the broker. A wide collection of market products allows investors to diversify their portfolios as they see fit.

These are not the only factors to consider but they are among the priorities. You should also consider the minimum deposit the broker requires, customer support, and even the range of accounts. With that said, let’s take a look at some of the best forex brokers that accept PayPal.

Best Forex Brokers That Accept PayPal

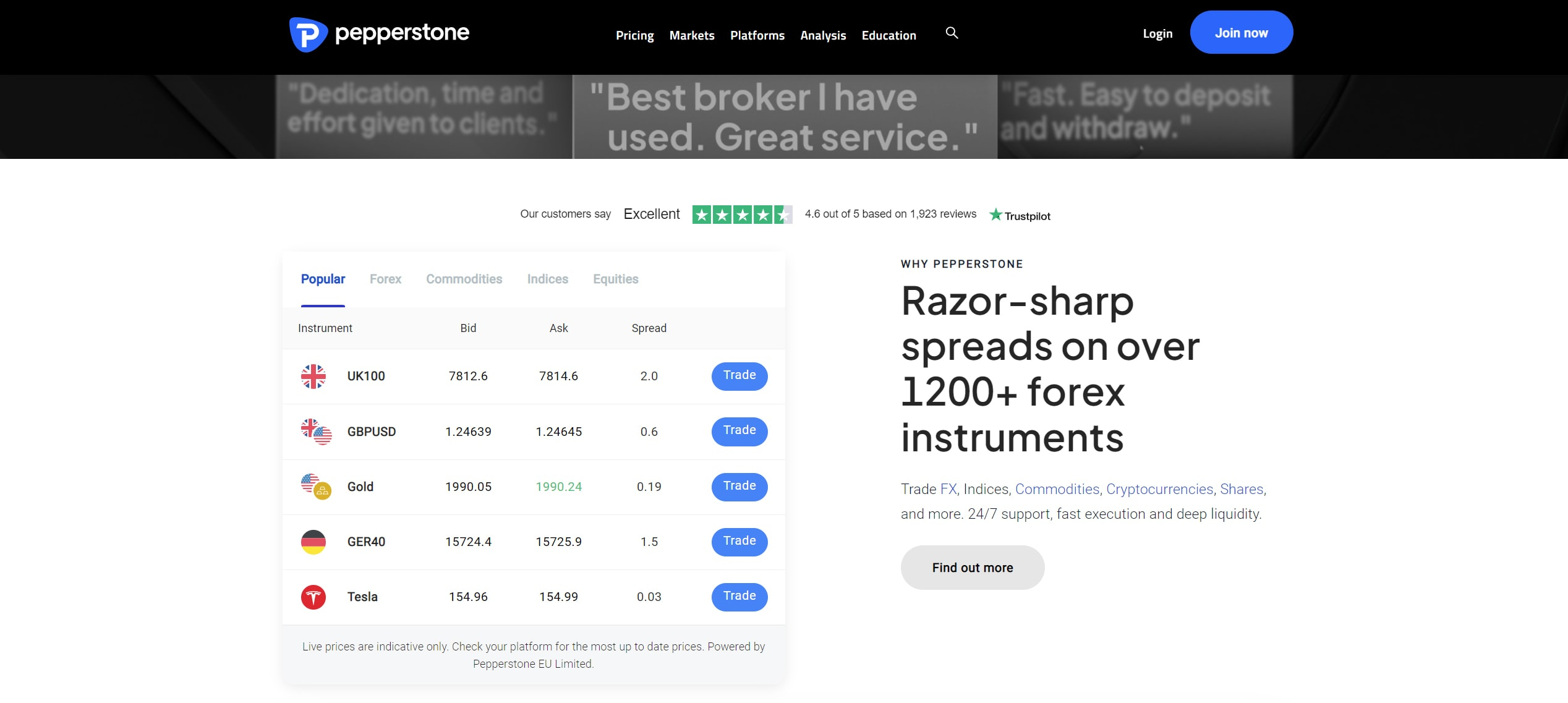

Pepperstone

Pepperstone is one of the top-tier brokers that accept PayPal. The broker allows for PayPal deposits and withdrawals without any charges. Deposits are processed immediately while withdrawals can take between 1 to 3 working days. One of the standout features of Pepperstone is its low entry point. There is no minimum deposit requirement to open an account with Pepperstone. This means that traders can invest whatever amount they want.

Positively, any account on this broker site offers traders a deep collection of market products. In total, this broker offers traders access to over 1,200 different instruments. These include CFDs on forex, commodities, indices, stocks, cryptocurrencies, and ETFs. Additionally, the broker offers several advanced trading platforms which include MetaTrader 4, MetaTrader 5, TradingView, cTrader, and Pepperstone Trading Platform.

Further, there are two different trading accounts with different pricing structures. The Standard account offers traders spreads from 1.0 pips for major currency pairs with no commission charged. On the other hand, the Razor account features raw spreads from 0.0 pips plus a commission depending on the trading platform a trader chooses.

MetaTrader 4 and MetaTrader 5 users pay a commission of $3.5 or €2.6 or £2.25 or CHF 3.30 per side per lot. Similarly, TradingView and Pepperstone Trading Platform users pay a commission of $3.5 per side per lot. In comparison, cTrader users pay a commission of $3 per side per lot. For non-USD users of cTrader, TradingView, and Pepperstone Trading Platform, the commission is converted into the base account currency at the spot rate.

Crucially, Pepperstone is regulated by some of the top financial institutions in the world. It operates under the supervision of the FCA in the UK, the CySEC in Cyprus, the ASIC in Australia, and the BaFin in Germany, among several others.

FP Markets

FP Markets is another top broker that accepts PayPal. The broker supports funding via PayPal on all its accounts, allowing traders to start trading as soon as possible. However, this payment option is only available to traders based in the EU. Both deposits and withdrawals are processed instantly with no fees charged. The minimum deposit when using PayPal is $50 or 50 EUR or 50 GBP.

On another note, this broker hosts one of the deepest collections of market products. On this broker site, investors can trade more than 10,000 CFDs on forex, cryptocurrencies, indices, commodities, ETFs, bonds, metals, and stocks. There are two trading accounts which charge differently when trading.

The Standard account features spreads from 1.0 pips for major currency pairs with no commission required. In contrast, the Raw account has raw spreads from 0.0 pips with a commission of $3 per side per lot. The trading platforms available to use include MT4, MT5, cTrader, TradingView, and Iress.

On regulations, FP Markets is under the supervision of several institutions. These include the ASIC in Australia, the CySEC in Cyprus, the FSCA in South Africa, and the CMA in Kenya, among others.

XTB

XTB is a well-established broker that is under the regulations of a variety of institutions. This broker operates under the supervision of the CySEC, the FCA, the KNF in Poland, and the FSC in Belize. This regulatory background is an attractive feature of XTB.

Notably, XTB supports deposits and withdrawals via PayPal, but only for traders based in the EU. This payment option does not charge traders any deposit fees. Positively, no minimum deposit is required to open an account with XTB. This means that traders can start investing with whatever amount they wish, making XTB highly accessible.

Once a trader makes a deposit, they gain access to a deep collection of market products. These include over 5,800 products which include CFDs on forex, cryptocurrencies, indices, commodities, stocks, and ETFs. The broker also gives access to real stocks and ETFs. To trade these market products, the company avails its own xStation 5 platform.

Finally, XTB charges highly competitive spreads to its traders. The standard account features spreads from as low as 0.8 pips on major currency pairs with no commissions charged.

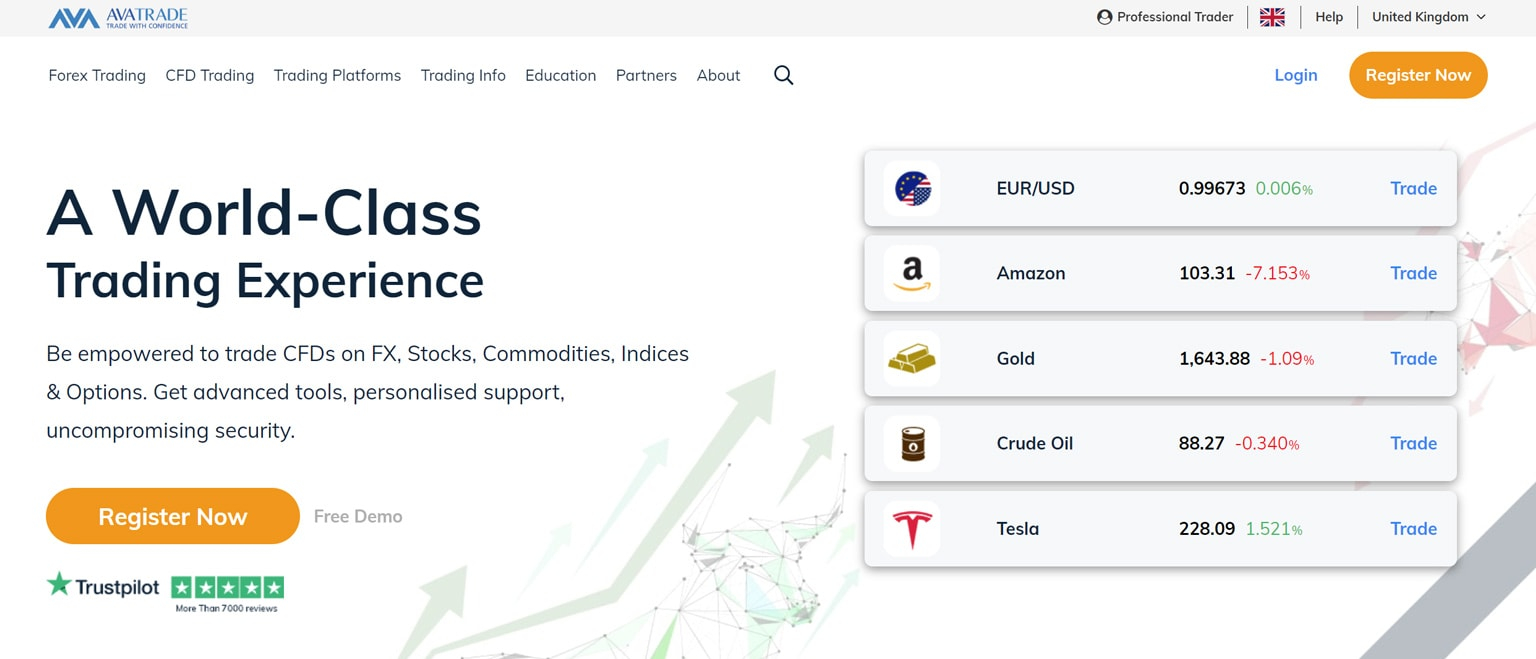

AvaTrade

Next up is AvaTrade. This is yet another well-established global broker with a strong presence in various regions. It supports PayPal as a deposit and withdrawal method, providing convenience to traders. When using this option, the funds will be credited to your account within 24 hours. The minimum deposit accepted by AvaTrade to open a trading account is $100.

Once investors open and fund their accounts, they gain access to a plethora of market products. This broker gives its clients access to over 1,250 instruments which include CFDs on forex, indices, commodities, ETFs, bonds, and cryptocurrencies. To trade these instruments, clients can choose between MetaTrader 4, MetaTrader 5, and AvaTradeGO. Positively, the broker also provides several trading tools to help investors in their trading activities.

These include the copy trading platforms AvaSocial and Duplitrade. Spreads for trading on the AvaTrade trading site are competitive, starting from as low as 0.9 pips on major currency pairs with no commission charged.

AvaTrade also boasts a strong regulatory background. It has regulations from the Central Bank of Ireland, ASIC in Australia, the FSCA in South Africa, the FSA in Japan, and the ADGM in the UAE, among others.

Eightcap

Eightcap is another highly-regarded broker that supports PayPal for deposits and withdrawals. Deposits are instantaneous, while withdrawals can take 1–5 business days to reflect in the trader’s account. Eightcap does not charge any fees for deposits and withdrawals via PayPal. The minimum deposit accepted by Eightcap to open a trading account is $100.

Eightcap offers access to a broad range of tradable assets, allowing traders to build a well-rounded portfolio. These include CFDs on forex, indices, commodities, shares, and cryptocurrencies. To trade these market products, traders can use TradingView, MT4, and MT5. There are also valuable trading tools available to use including Capitalise.ai and FlashTrader, among others.

Trading costs with Eightcap are competitive. On the Standard and the TadingView accounts, the spreads start from 1.0 pips for major currency pairs with no commission charged except on shares. In contrast, the Raw account has spreads from 0.0 pips plus a commission of $3.5 or 2.25 GBP or 2.75 EUR per side per lot.

On the regulatory front, Eightcap operates under the supervision of multiple authorities. These include the FCA, the ASIC, and the SCB in the Bahamas.

IC Markets

IC Markets is another top-tier forex broker that supports PayPal as a payment method. This broker has regulations from several institutions around the world. It operates under the strict supervision of the ASIC, the CySEC, the FSCA, and the SCB. This robust regulatory framework is what makes IC Markets one of the best forex brokers that accept PayPal.

When using PayPal to make deposits, traders can expect the broker to process the transaction instantaneously. While it doesn’t give a timeline, IC Markets also promises fast processing of withdrawals via PayPal. There are a ton of currencies supported by this payment option including AUD, USD, JPY, EUR, NZD, and SGD, among others. The minimum deposit required to open an account with IC Markets is $200.

Notably, IC Markets offers its clients a deep collection of market products totalling over 2,100 instruments. On this broker site, investors have access to CFDs on forex, cryptocurrencies, stocks, indices, commodities, and futures. Traders can use a variety of platforms to trade these markets including MT4, MT5, WebTrader, and cTrader.

On another note, this broker is renowned for its competitive trading conditions. The Standard Account features spreads starting at 0.8 pips on major currency pairs and does not charge any commissions. In contrast, the Raw Spread Account offers spreads beginning at 0.0 pips but includes a commission that varies by the trading platform. On the cTrader platform, the Raw Spread Account has a commission of $3 per $100,000 traded, whereas on MetaTrader platforms, the commission is $3.5 per side per lot.

List of All Forex Brokers that Accept PayPal

Here is an extended list of well-known forex brokers that accept PayPal:

- Pepperstone

- FP Markets

- XTB

- AvaTrade

- Eightcap

- IC Markets

- eToro

- Forex.com

- IG

- CMC Markets

- City Index

- Capital.com

- Plus500

- Admiral Markets (UK Only)

- Vantage Markets

- FxPro

- Oanda

- Trading 212 (UK Only)

- Fusion Markets

- Global Prime

- Axi

- Libertex

- FXGlory

- RoboForex

- Skilling

- Capital Core

Benefits of Using PayPal with Forex Brokers

Using PayPal as a payment method for forex trading offers several advantages:

- Instant Transactions – Deposits via PayPal are typically processed almost instantly, ensuring uninterrupted trading.

- Wide Accessibility – PayPal is available in over 200 countries and supports multiple currencies.

- Low Fees – While PayPal charges transaction fees, many brokers absorb these costs.

- Enhanced Security – PayPal’s buyer protection and encryption ensure secure transactions

- Easy Withdrawal – While withdrawing funds using PayPal takes some time, it is generally easy.

Potential Drawbacks of PayPal Forex Brokers

- Availability – Not all brokers support PayPal, limiting your options. Your broker of choice may not support PayPal.

- Fees – While some brokers waive fees, PayPal itself may charge transaction fees for currency conversions.

- Country Restrictions – PayPal services are not available in certain countries, restricting access for traders in those regions.

Alternatives to PayPal

While PayPal is a popular option, it is not available in all countries and it may not be available on your broker of choice. Luckily, it’s not the only way to fund your forex trading account. Here are some alternatives:

- E-wallets – E-wallets are a great alternative to PayPal. They offer fast transactions at generally low fees. Popular e-wallets include Skrill and Neteller.

- Credit/Debit Cards – Many forex brokers accept credit and debit cards, such as Visa, Mastercard, Maestro, and American Express.

- Bank transfers – Bank transfers are a reliable method for funding your forex trading account, particularly for large transactions. While they may take longer to process compared to other payment options, many brokers now offer local bank transfer services that significantly speed up the process.

- Cryptocurrencies – Some forex brokers accept cryptocurrencies, such as USDT, Bitcoin and Ethereum. This can be a good option if you are looking for a fast, secure, and anonymous way to fund your account.

- Other Local Payment Methods – Depending on the region, brokers may support local payment systems like BPay, UPI, or FasaPay. Some brokers also support mobile money platforms such as MPesa, Airtel Money, and MTN MoMo.

Conclusion

PayPal offers traders a convenient, secure, and fast way to fund their forex trading accounts. There are a number of reputable forex brokers that accept PayPal, so you should be able to find one that meets your needs. The brokers we featured here are among the best in the industry offering PayPal as a payment option. Additionally, they offer excellent trading conditions including low spreads, advanced trading platforms, and a deep collection of instruments.

Needless to say, this may not be the full list of forex brokers that accept PayPal. As such, we encourage everyone to do their own research to find a broker that best suits their needs. When choosing a broker, always prioritize regulation, trading conditions, and payment flexibility. This is the best way to ensure a seamless trading experience.

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.