The Netherlands is one of the most advanced and stable economies in Europe. Historically, countries with stable economies make an attractive environment for forex trading. Moreover, the favourable regulatory environment in the Netherlands ensures that brokers operating within its borders provide a safe and transparent trading environment.

For traders in the Netherlands, it is crucial to choose a reliable broker with robust regulations. However, with a wide range of brokers available, it can be challenging for traders to choose the best one for their needs. This review will highlight some of the best forex brokers in the Netherlands, focusing on their standout features.

Our Criteria For Selecting The Best Forex Brokers in the Netherlands

Below are some of the key factors we will consider when selecting the best forex brokers in the Netherlands:

- Regulation – Regulation is the most crucial factor when selecting a forex broker. In the Netherlands, the forex exchange market is under the regulation of the Authority for the Financial Markets. However, brokers with licenses in other EU states can operate in the Netherlands without a license, thanks to the European Economic Area (EEA) agreement.

- Spreads and Fees – The cost of trading, including spreads and commissions, should be transparent and competitive. Brokers that offer tight spreads and low commissions tend to be more attractive to traders.

- Trading Platforms – The quality of a broker’s trading platform plays a significant role in the success of forex traders. The platform offered should be user-friendly, stable, and equipped with advanced trading tools.

- Collection of Market Products – A diverse selection of market products is essential for traders who wish to expand beyond forex trading. Leading brokers often offer a broad range of asset classes.

Now that we understand the criteria we will use, let’s review some of the best forex brokers in the Netherlands.

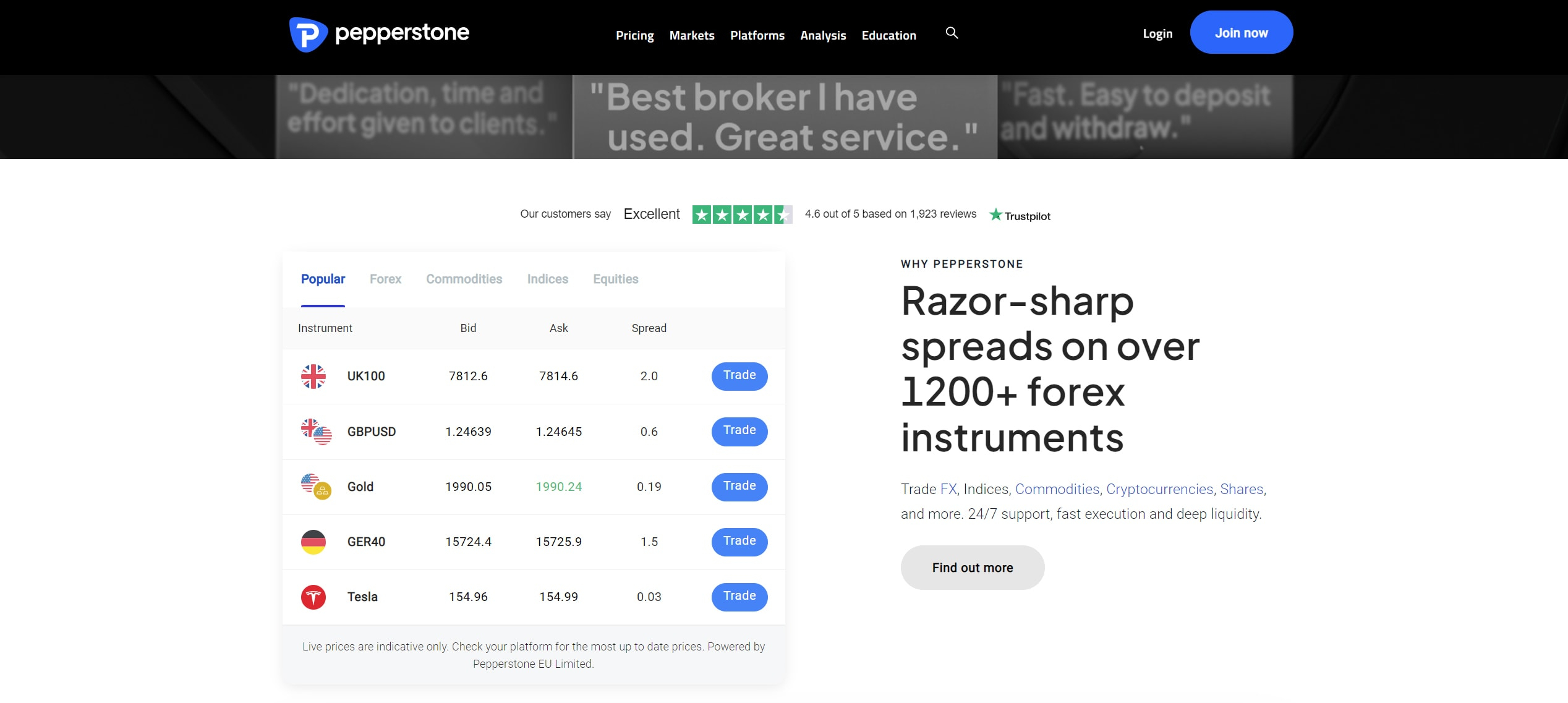

Pepperstone

Pepperstone is one of the top forex brokers in the Netherlands and the world. This broker operates in the Netherlands under its European branch which is regulated by the CySEC in Cyprus. On top of that, this broker holds licenses in a plethora of other countries including in the UK by the FCA, in Australia by the ASIC, and in Germany by the BaFin, among others.

Additionally, this broker offers traders a deep collection of market products to explore. On the Pepperstone broker site, traders in the Netherlands gain access to over 1,200 different CFDs. Specifically, investors have access to assets from the forex, indices, commodities, cryptocurrencies, currency indices, ETFs, and share markets. The trading platforms available to use include MetaTrader 4, MetaTrader 5, TradingView, cTrader, and Pepperstone Trading Platform.

Additionally, Pepperstone offers some of the most competitive spreads in the market. The Standard account features spreads starting from 1.0 pips with no commission fees. On the other hand, the Razor account provides spreads on forex as low as 0.0 pips, with a small commission of €2.6 per side per lot when using the MetaTrader platforms. For TradingView and cTrader platforms the commission fee is only slightly higher.

Positively, Pepperstone does not have a minimum deposit requirement. This allows investors to invest whatever amount they choose. There are a variety of payment options supported including Visa, Mastercard, Bank transfer, BPay, and PayPal. Additionally, the broker supports a variety of base account currencies including the EUR, USD, JPY, GBP, and more.

FP Markets

FP Markets is another great option for traders in the Netherlands. This broker is regulated in Cyprus by the CySEC, allowing it to operate within the EEA zone freely. Additionally, FP Markets holds licenses from the ASIC in Australia, the FSCA in South Africa, and the CMA in Kenya. Always remember that regulations alone are not enough. However, this broker has been in the market since 2005 without much problems, which is a good sign.

On another note, FP Markets provides access to an extensive selection of over 10,000 financial instruments. Investors can trade CFDs on forex currency pairs, indices, metals, stocks, commodities, ETFs, cryptocurrencies, and bonds. This wide range of assets allows for effective portfolio diversification within a single broker platform. FP Markets supports various platforms including MetaTrader 4, MetaTrader 5, TradingView, Iress, and cTrader.

FP Markets provides competitive pricing aimed at maximising trading profits. The Standard account offers spreads as low as 1.0 pips on major currency pairs with no commission fees. In contrast, the Raw account delivers spreads starting from 0.0 pips, with a commission of $3 (approximately €2.8) per side per lot.

The minimum deposit to start investing with FP Markets is €100. There are plenty of payment options supported by FP Markets including Credit/Debit Cards, Bank Transfers, Neteller, Skrill, PayTrust (Local Bank Transfer), Crypto Payments, and more. Additionally, there are plenty of account currencies supported including EUR, USD, GBP, and NZD, among others.

XTB

XTB is a well-established forex broker with a strong presence in the Netherlands. This broker has regulations by the CySeC in Cyprus alongside other regulations. It is also under the regulation of the FCA in the UK, the KNF in Poland, and the FSC in Belize. Needless to say, brokers with multiple regulations are more attractive to traders.

XTB offers access to a wide array of financial instruments, totalling over 5,800 different instruments. Dutch traders can explore CFDs on forex, commodities, cryptocurrencies, indices, stocks, and ETFs. They can also buy and sell real stocks and ETFs on the XTB broker site. To trade these market products, XTB provides its proprietary trading platform, xStation 5. The platform is known for its intuitive design, powerful analytical tools, and fast execution speeds.

One of the key advantages of XTB is its competitive spreads and low fees. Its standard account features tight spreads starting from 0.8 pips on major currency pairs, with no commission fees. There is no minimum deposit requirement on XTB, making it accessible for traders of all levels. Some of the payment methods that traders can use include bank transfers, credit/debit cards, and electronic wallets such as PayPal and Paysafe (formerly Skrill). It supports a variety of account currencies depending on the region. For traders in the Netherlands, the account currency supported is the Euro (EUR).

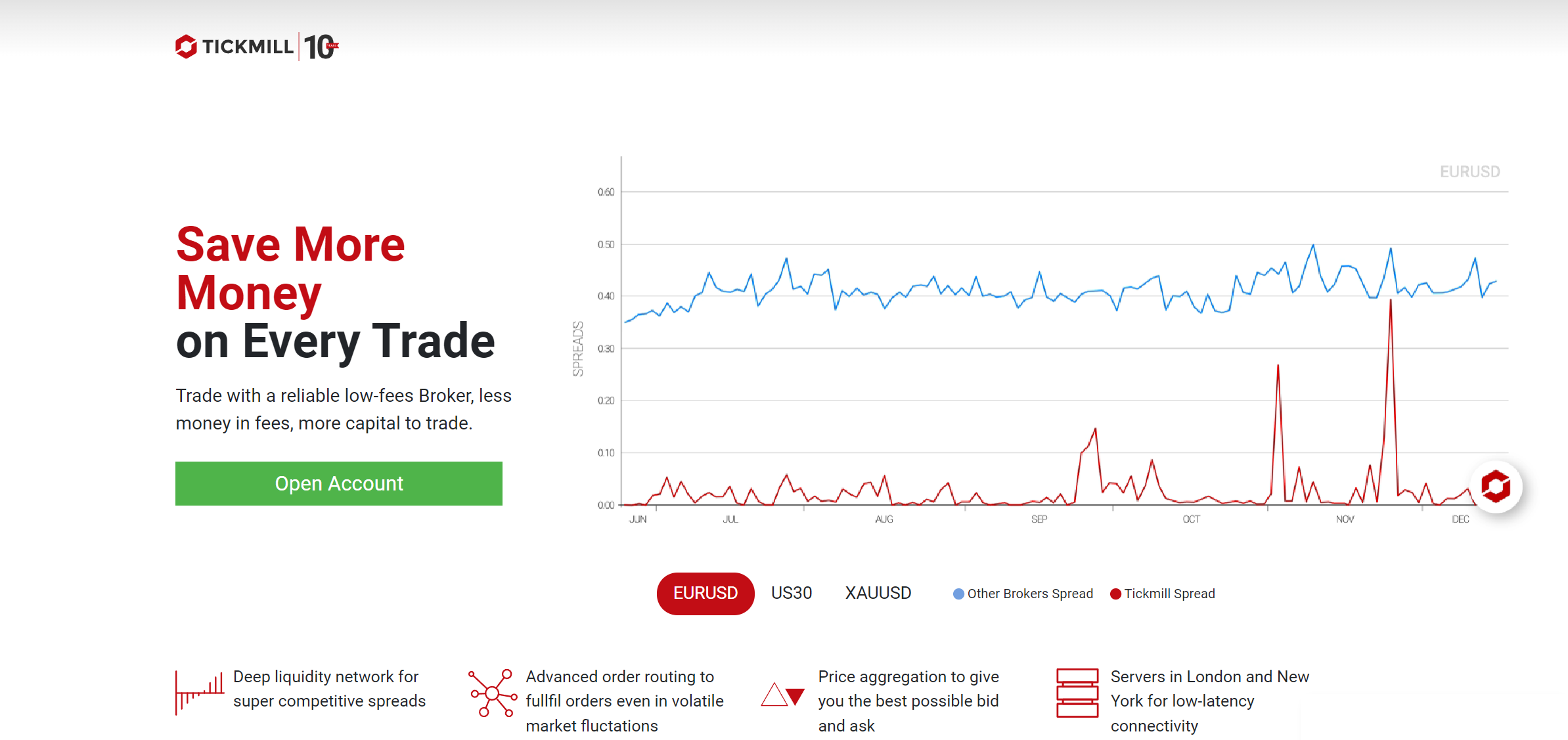

Tickmill

Tickmill is another reputable broker that provides Dutch forex traders with a competitive trading environment. This is a regulated broker in Cyprus by the CySEC, in the UK by the FCA, in Australia by the ASIC, and in the Seychelles by the FSA. These regulators require Tickmill to maintain high standards of transparency and investor protection.

Tickmill provides traders in the Netherlands with a wide selection of trading instruments. These include CFDs on forex, stock indices, metals, bonds, commodities, and cryptocurrencies. This broker is known for offering competitive spreads across its product range, making it cost-effective for traders. Tickmill offers two main account types to suit various trading preferences: the Classic account and the Raw account.

The Classic account provides spreads starting from 1.6 pips on major currency pairs with no commission. The Raw account offers even tighter spreads, beginning at 0.0 pips on major pairs, with a small commission of $3 (approximately €2.8) per lot per side. Tickmill supports multiple trading platforms, including MetaTrader 4, MetaTrader 5, TradingView, and its proprietary Tickmill Trader platform, catering to diverse trading styles and needs.

Tickmill requires a minimum deposit of €100, and traders have multiple funding options available. These include bank transfers, credit/debit cards, Neteller, SticPay, FasaPay, and Skrill, among others. The Euro is one of the several supported account base currencies on this forex broker site.

Forex.com

Forex.com is a globally recognised broker with regulations in a variety of jurisdictions. Its parent company, StoneX, holds regulatory licenses by the CySEC, the FCA, the ASIC, and the CFTC and NFA in the US. With such regulations, it is easy to understand why this broker is highly regarded as one of the top forex brokers for Dutch traders.

Moreover, Forex.com offers a diverse range of tradable assets totalling over 5,500 different assets. These include CFDs on forex, stocks, indices, cryptocurrencies, commodities, and precious metals. Traders can access these markets through advanced platforms like MetaTrader 4, MetaTrader 5, TradingView, and Forex.com Trader.

Further, Forex.com is known for its competitive spreads across various account types. The Standard account offers spreads from 1.0 pips on the WebTrader platform, while the MetaTrader account also starts at 1.0 pips for MetaTrader users. Neither account charges a commission. Alternatively, the Raw account features spreads from 0.0 pips, with a commission of $5 per $100,000 traded (approximately €4.60 per €100,000 traded).

Forex.com requires a minimum deposit of €100 and supports a range of funding options. These include credit/debit cards, bank transfers, Skrill, Neteller, and PayPal. The Euro is one of the supported currencies alongside the USD, the GBP, CAD, and the AUD, among others.

XM

XM is a well-established forex broker regulated by multiple authorities. This broker has regulation by the CySEC for operations within the EU, ensuring it operates legally for traders in the Netherlands. On top of that, the broker holds regulatory licenses from the ASIC and the FSC in Belize. On another note, XM provides a diverse range of trading instruments, including CFDs on forex, stocks, indices, precious metals, and energies. This selection allows Dutch traders to explore a variety of financial markets from a single platform.

XM offers several account types for traders to choose from. These include the XM Ultra Low account and the Zero account. The XM Ultra Low account offers traders spreads from as low as 0.8 pips with no commission charged. In contrast, the XM Zero account offers spreads from as low as 0.0 pips, with a commission of $3.5 per $100,000 (approximately €3.2 per €100,000) traded.

XM has a low minimum deposit requirement of €5, making it highly accessible to traders of all levels. Dutch traders can fund their accounts through multiple payment methods, including Wire Transfers, Skrill, Neteller, Credit and Debit cards, and PayPal. The Euro is available as a base account currency on this broker site.

Closing Remarks

The Netherlands offers a stable environment for forex trading, but selecting the right broker is crucial. Luckily, Dutch traders have access to a range of top-tier forex brokers to choose from, each offering unique features.

This article analyzed several top brokers based on key factors like regulation, spreads and fees, trading platforms, and market products. While these brokers offer great options to traders, the best broker depends on your individual needs and priorities. It’s essential to conduct thorough research and consider your individual financial circumstances before making any investment decisions.

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.