The S&P 500 is one of the most widely traded stock market indices in the world. It is an index that tracks the performance of 500 of the largest publicly traded companies in the United States, covering a wide range of sectors. As such, many traders use it as a gauge of the development of the US economy and market sentiment.

For traders looking to gain exposure to the S&P 500, choosing the right broker is crucial. The broker they select can significantly impact their trading experience, costs, and overall success. In this article, we will explore some of the best brokers for trading the S&P 500, focusing on their key features. Let’s begin.

How To Trade S&P 500

Traders can trade the S&P 500 index through various financial instruments, each offering unique advantages and risks. The two major ways for trading the S&P 500 are through ETFs (Exchange Traded Funds) and CFDs (Contracts for Differences).

In this guide, we are going to cover brokers who offer trading of the S&P 500 as ETFS and those who offer through CFDs. Please note that most brokers do offer S&P 500 ETFs as CFDs. Let’s take a look at some brokers that offer trading of the S&P 500 index through CFDs.

Trading The S&P 500 Through CFDs

An Index CFD is a financial instrument that allows traders to speculate on the price movements of a stock market index without owning the underlying assets. Instead of purchasing individual stocks, traders can trade a CFD that tracks the entire index. Here are some well-regarded brokers that offer S&P 500 index CFDs:

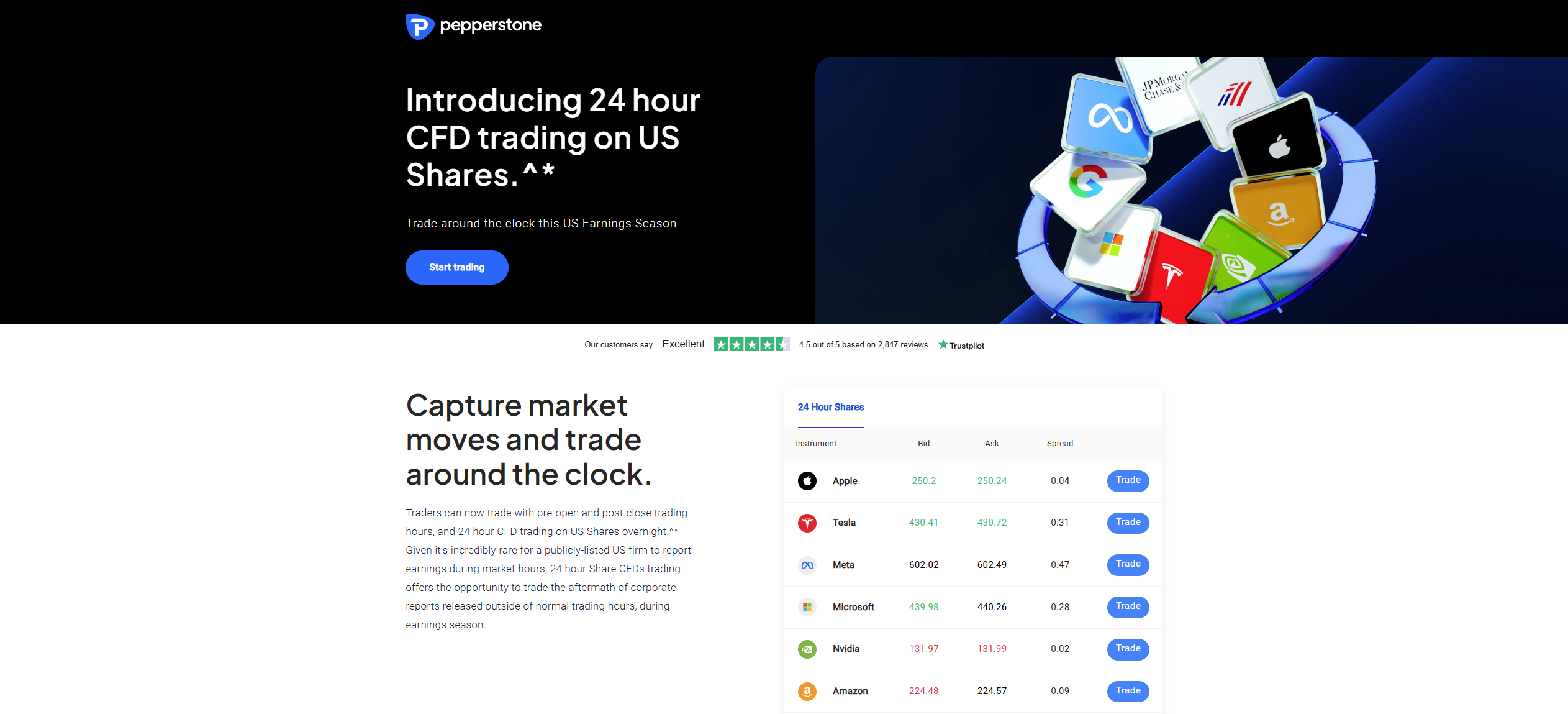

Pepperstone

Pepperstone is an international forex and CFDs broker that offers services in over 170 countries. This broker offers the S&P 500 index as a CFD under the ticker US500. On this broker site, the US500 index is available with a minimum and average spread of 0.4 points on all its accounts. Traders have a variety of trading platforms to place orders, including MT4, MT5, TradingView, cTrader, and Pepperstone Trading Platform.

Notably, this broker gives investors access to a ton of other market products. Particularly, this broker allows traders to speculate on CFDs on forex, other indices, ETFs, cryptocurrencies and shares. In total, there are over 1,200 different market products.

Further, Pepperstone has a strong regulatory background as it holds licenses in a variety of jurisdictions. It operates under the supervision of the CySEC in Cyprus, the FCA in the UK, the DFSA in Dubai, and the BaFin in Germany, among others.

Exness

Exness is another top-tier forex and CFDs broker, highly regarded for offering CFDs on the S&P 500 index. This broker avails the index under the ticker US500, with spreads depending on the account. The standard account has an average spread of 5.8 pips for the US500 index with no commission charged. On the other hand, the pro account has an average spread of 4.0 pips with no commission charged. Further, the zero account has an average spread of 0.0 pips for the US500 index with a commission of $0.5 per side per lot. Meanwhile, the raw spread account has an average spread of 0.0 pips plus a commission of $0.25 per side per lot.

On another note, Exness offers its clients great opportunities to diversify their portfolios. This broker supports the trading of CFDs on forex, cryptocurrencies, other indices, commodities, and stocks. To trade these market products, traders can use Exness Terminal, MetaTrader 4, MetaTrader 5, and Exness Trader app.

Finally, we must mention the regulatory background of this broker. Positively, it has authorisation and regulation by the FCA in the UK, the CySEC in Cyprus, the CMA in Kenya, and the FSCA in South Africa, among others. While regulations alone are not enough, brokers with extensive regulations are generally considered reliable.

While Exness accepts traders from most countries around the world, they do not accept retail clients from the UK and EEA countries, among others.

FP Markets

FP Markets offers a compelling offer for traders looking to trade the S&P 500 index. The broker offers this index as a CFD with some of the lowest spreads, averaging a low 0.45 points with no commission. These are some of the lowest rates for trading this index on a broker site. The trading platforms available to use include TradingView, MT4, MT5, and cTrader.

Crucially, this broker allows its investors to access over 10,000 market products. Specifically, clients of this broker can trade CFDs on forex currency pairs, commodities, cryptocurrencies, other indices, bonds, stocks, and metals. Such market diversity allows investors to diversify their portfolios as they see fit.

Finally, the extensive regulations of this broker are what makes FP Markets stand out among brokers offering S&P 500 trading. It holds regulatory licenses from the ASIC, the CySEC, the FSCA, and the CMA.

XM

XM is a popular broker with over 15 million clients from over 190 countries. Notably, XM offers the S&P 500 both as a cash CFD and as a futures CFD. The cash CFD is available under the ticker US500Cash and has a minimum spread of 0.57 points and a similar average of 0.57 points. On the other hand, the futures CFD is available under the ticker US500 with a minimum spread of 1.20 points and an average of 1.24 points.

XM offers a deep collection of market products for people to trade alongside the S&P 500 index. Particularly, this broker offers CFDs on forex, other indices, stocks, cryptocurrencies, energies, and precious metals like gold.

Like other top-rated brokers, XM has regulations from various authorities. Specifically, this broker operates under the regulation and supervision of the CySEC, the ASIC, and the FSC in Belize.

Benefits of Trading The S&P 500 As A CFD

- Liquidity & Volatility – The S&P 500 is one of the most liquid indices, ensuring tight spreads and efficient execution.

- Leverage – CFDs generally offer high leverage to traders, allowing traders to control larger positions with a smaller initial investment. However, this should be approached with caution as it comes with the significant risk of amplified losses.

- Flexibility – Many brokers support the use of various trading strategies like hedging and scalping on CFDs.

However, it is important to note that CFDs do not offer the opportunity to own underlying assets when trading.

Trading The S&P 500 Through ETFs

An ETF is a type of investment fund that trades on stock exchanges, similar to individual stocks. An S&P 500 ETF mirrors the performance of the S&P 500 index. It holds the same stocks in the same proportions as the index. This allows investors to buy a single ETF share representing a diversified portfolio of 500 companies. Here are some brokers that offer S&P 500 trading through ETFs:

eToro

eToro is one of the largest brokers in the world, with over 38 million registered users worldwide. This broker offers four different S&P 500 ETFs both as real assets and as CFDs. These include the Vanguard S&P 500 ETF managed by Vanguard Group, the SPDR S&P 500 ETF managed by State Street Global Advisors, the Direxion Daily S&P 500 Bull 3x managed by Rafferty Asset Management, and the Invesco S&P 500 Equal Weight ETF managed by Invesco.

eToro does not charge any commissions when trading ETFs as real underlying assets nor does it apply its own spread fee. A market spread is available depending on the market conditions. On the other hand, eToro does charge a spread fee on ETF CFDs. The spread for ETF CFDs on eToro is 0.15%. Additionally, CFD positions in US-listed stocks & ETFs priced at $3 or less will incur a fee of 2 cents per unit.

Positively, ETFs are not the only assets available on eToro. In total, this broker allows its clients to trade over 7,000 different financial instruments. These include CFDs on forex, indices, commodities, stocks, and cryptocurrencies. Additionally, this broker offers the trading of real stocks and cryptocurrencies. The trading platform available to use is the broker’s proprietary, eToro platform.

One of eToro’s standout features is its strong regulatory background. It operates under the regulation of various organisations including the FCA in the UK, the CySEC in Cyprus, the ASIC in Australia, and the FSA in Seychelles, among others.

XTB

XTB is another well-regarded broker that allows investors to trade the S&P 500 as an ETF. There are a ton of real S&P 500 ETFs whose accessibility depends on a trader’s location and account currency. Notably, trading real stocks and ETFs is commission-free for monthly turnovers up to $100,000. After that, a 0.2% commission applies with a minimum commission of $10.

XTB also offers S&P 500 ETFs as a CFD. Specifically, it offers the SPDR S&P 500 ETF managed by State Street Global Advisors under the ticker SPY.US. There is no commission charged when trading this ETF CFD and the spreads are floating, depending on market conditions.

Like eToro, XTB also offers a ton of other trading instruments other than ETF CFDs. This broker also supports the trading of CFDs on forex, indices, stocks, commodities, and cryptocurrencies. The broker also allows people to trade real stocks and ETFs. To trade these various markets, the broker avails its proprietary xStation 5 platform.

On regulations, this broker features a multi-regulatory framework. It operates under the supervision of the FCA in the UK, the CySEC in Cyprus, the FSC in Belize, and the KNF in Poland. This is part of the reason why XTB is favoured as one of the best brokers for S$P 500 trading.

Interactive Brokers

Interactive Brokers also certainly deserves a spot among the best brokers for trading the S&P 500. Notably, Interactive Brokers offers a variety of S&P 500 ETFs depending on the location of a trader. Some examples of the S&P 500 ETFs include the iShares Core S&P 500 UCITS ETF managed by BlackRock and the Vanguard S&P 500 UCITS ETF managed by Vanguard. It also includes the Invesco S&P 500 UCITS ETF managed by Invesco Asset Management Limited and the Xtrackers S&P 500 Swap UCITS ETF managed by S&P Dow Jones Indices LLC.

When trading ETFs, Interactive Brokers charges a commission of 0.05% with a minimum commission of $1 and a maximum of 1% of the trade value. The trading platforms available for traders to use include Trader WorkStation and the IBKR Platform. Further, this broker offers access to a variety of other global markets, including forex currency pairs, stocks, options, futures, bonds, and cryptocurrencies.

Finally, this is a well-regulated broker with licenses in various jurisdictions. It holds regulatory licences from the SEC and CFTC in the US, the FCA, the ASIC, and the CIRO in Canada. On top of that, it is listed on the NASDAQ under the ticker IBKR, ensuring a high level of scrutiny and transparency.

Benefits of Trading The S&P 500 As A ETF

- Low Costs – ETFs are generally associated with low trading costs compared to some other financial instruments.

- Asset Ownership – When you invest in an ETF, you own a share of the fund, which in turn owns the underlying assets. This gives you a stake in the actual assets.

- Transparency – ETFs disclose their holdings daily, so investors know exactly what assets they own.

It’s important to note that ETFs generally have lower leverage available or no leverage at all. This can significantly reduce the risk associated with leveraged trading, but it also lowers the potential profits a trader may gain from leveraged positions. Brokers who offer S&P 500 indices as ETF CFDs essentially combine the benefits of both ETFs and CFDs.

Closing Remarks

The S&P 500 index is one of the most popular indices for investors to trade. It offers the opportunity for traders to diversify their portfolios by investing in a single asset. This is because the S&P 500 index tracks the performance of many companies across a wide range of sectors. However, choosing the right broker for trading the S&P 500 index is a crucial step for each investor.

The best broker for S&P 500 trading ultimately depends on your individual trading style, budget, and investment goals. Whether through CFDs or ETFs, the brokers we listed here have compelling offerings to their traders. They feature industry-standard trading platforms, competitive fees, and other assets for portfolio diversification. On top of that, they operate under the regulation of top financial authorities. Remember to conduct thorough research and consider your investment objectives before making any investment decisions.