One of the key factors that traders consider when choosing a broker is the spread involved. The spread is the difference between the bid and ask price of a currency pair. On most broker sites, it represents the cost of trading. Notably, some brokers offer variable spreads that fluctuate depending on market conditions. In contrast, some other brokers offer fixed spreads that remain the same regardless of the market conditions. Fixed spreads brokers are a great option for traders who prefer predictability in their trading costs. In this detailed review, we are going to be looking at some of the best brokers with fixed spreads. To determine which ones stand out from the rest, we will consider the regulatory status, trading platforms, and collection of market instruments. Buckle up and let’s dive in.

Why Choose Fixed Spreads?

Before we list the brokers, let’s just briefly highlight the benefits of using a fixed spreads broker while trading. Fixed spreads offer several advantages, especially for traders who prefer predictability in their trading costs. Here are some key benefits:

- Predictability – With fixed spreads, traders know exactly how much they will pay in spread costs for each trade. This makes it easier to manage and predict trading expenses.

- Stability – Fixed spreads remain constant even during times of high market volatility, providing stability and reducing the risk of unexpected spread widening.

- Transparency – Fixed spreads offer greater transparency as traders are not subject to fluctuating costs.

Now let’s shift our focus and explore some of the best brokers with fixed spreads.

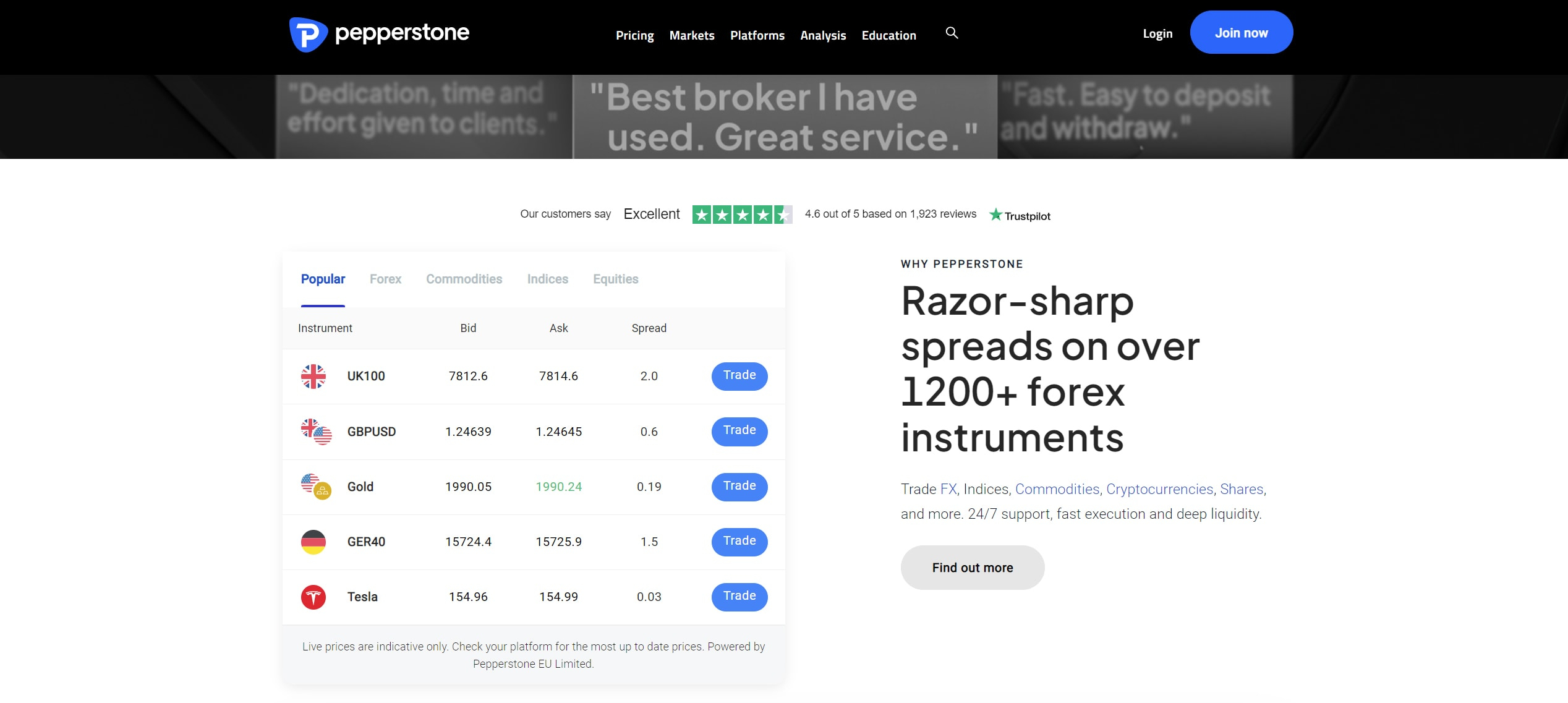

Pepperstone

Pepperstone also offers its traders both variable and fixed spreads. However, the fixed spreads option is only available when trading indices. On this broker site, spreads on indices are fixed regardless of the market conditions. The spreads are as low as 1 point on AUS200, 1.2 on GER30 and 2.4 on US30, with no commissions.

Nonetheless, traders can invest in more than just indices on Pepperstone. In total, they have over 1,200 different market products to trade on the Pepperstone broker site. These include CFDs on Forex, commodities, indices, cryptocurrencies, shares, and ETFs. The diversity offered by Pepperstone allows traders to spread their risk across the various markets and possibly increase their profit. The trading platforms available to use include MetaTrader 4, MetaTrader 5, cTrader, Pepperstone Trading Platform, and TradingView.

Like the other brokers on this list, Pepperstone is well-regulated across a variety of jurisdictions. These include the CySEC in Cyprus, the ASIC in Australia, the FCA in the UK, the CMA in Kenya, and BaFin in Germany.

AvaTrade

AvaTrade is one of the most popular brokers that offers its traders fixed spreads. Being a market maker, this broker buys up large positions from liquidity providers and then sells them off to retail traders in smaller portions. This way, the broker can fill the orders of its traders using its in-house dealing desk. The advantage of this is that the broker is able to set its own prices. Consequently, it can keep spreads fixed in most cases. However, it is important to keep track of the spreads as they can change (according to their official site they are over-market).

Positively, this broker provides some of the lowest spreads in the market. The broker offers spreads that start from as low as 0.9 pips for major currency pairs with no commission required. The trading platforms available to use when trading with this broker include MetaTrader 4, MetaTrader 5, and AvaTradeGO. These trading platforms allow investors to access a wide range of market products that include CFDs on forex, metals, commodities, indices, bonds, ETFs, and equities.

We always insist that traders should never invest with a broker that lacks regulations. While regulations alone are not enough, they are a sign of a broker that follows the financial laws of the jurisdiction it operates in. Fortunately, AvaTrade is well-regulated by the CySEC in Cyprus, the Central Bank of Ireland in Ireland, and the KNF in Poland, among others.

Forex.com

Forex.com offers its traders fixed spreads on one specific asset class, indices. On this broker site, traders can invest in indices without worrying about the spreads changing due to market conditions. As expected, the spreads on indices on this broker site depend on the index you are investing in. The spreads start from as low as 0.3 for the US Small Cap 2000 index.

While this is the only asset group with fixed spreads, it is not the only market group available to trade. On this broker site, traders can access over 5,500 different market products that include CFDs on forex, Indices, stocks, commodities, and cryptocurrencies for global traders excluding the US. US clients can trade actual forex pairs, real stocks, futures and futures options. The trading platforms available to use include MetaTrader 4, MetaTrader 5, TradingView, and Forex.com Trader.

Finally, on regulations, this broker does not disappoint. Its parent company, StoneX, holds licenses from the CFA in the UK, the CySEC in Cyprus, the ASIC in Australia, and the CFTC and NFA in the US, among others.

EasyMarkets

EasyMarkets is yet another broker that offers its traders fixed spreads when trading. On this broker site, traders can access both fixed spreads and variable spreads depending on the platform that a trader uses. Fixed spreads are available for traders who use EasyMarkets trading platforms, TradingView, and MetaTrader 4. On the other hand, variable spreads are available for traders using MT5 to trade.

Notably, the spreads also depend on the account a trader uses. When using MT4, the spreads for the EURUSD pair are 0.7 pips on the VIP account, 1.2 pips on the Premium account, and 1.7 pips on the standard account. The fixed spreads are slightly higher on the EasyMarkets trading platforms and on TradingView.

Further, this broker gives its traders access to a deep collection of market products across a variety of asset classes. This includes market products from the forex, commodities, indices, and cryptocurrencies groups of assets.

On another note, this broker has regulations from various institutions. These include the ASIC in Australia, the CySEC in Cyprus, the FSA in Seychelles, and the British Virgin Islands Financial Services Commission.

FxPro

FxPro is another well-known broker that offers its traders fixed spreads. Particularly, this broker provides a custom account for traders who want to trade with fixed spreads. The MT4 Fixed Account on this broker site offers fixed spreads on 9 major currency pairs and one minor during certain time periods. The currency pairs with fixed spreads on this account include EURGBP, EURJPY, EURUSD, GBPJPY, GBPUSD, USDCAD, USDJPY, USDCHF, EURCHF and AUDUSD.

The spreads on this account are fairly high compared to the other accounts and other brokers. For example, the USDEUR pair has a spread of 2.0 pips between 23:00 and 08:00 (UK Time). In contrast, the same currency pair has a spread as low as 1.8 pips between 08:00 and 21:00 (UK time). The minimum spread for this currency pair on the MT4 Fixed account is 1.80 pips and the average is 1.85 pips.

On the other accounts, traders can access other market products in various global markets. This includes CFDs on other forex pairs, futures, indices, shares, and cryptocurrencies. The trading platforms that traders can use to trade on FxPro include cTrader, MetaTrader 4, MetaTrader 5, and the FxPro proprietary platform. These platforms are some of the fastest trading platforms in the market which gives traders an added advantage in the market.

Finally, this broker is under the regulation of a variety of financial institutions. These include the FCA in the UK, the CySECin Cyprus, and the FSCA in South Africa.

HYCM

HYCM is a global broker with over 40 years of experience in the market. This broker offers its traders fixed spreads on a specific account designed for traders who prefer fixed spreads. On this account, traders can trade with spreads that start from as low as 1.5 pips for major currency pairs with no commission required.

With this broker, investors have access to a comprehensive range of products including forex, stocks, indices, cryptocurrencies, and commodities. To trade on these markets, traders can use powerful platforms like MT4, MT5, and HYCM Trader. These platforms work on all kinds of devices, from computers to phones.

Transparency and security are key, so let’s look at this broker’s regulatory framework. Well, it is overseen by some of the most respected financial authorities globally, including the FCA, CySEC, and CIMA. Notably, FCA and CySEC regulations are particularly stringent, ensuring a high level of client protection

Closing Remarks

Choosing a broker with fixed spreads can offer numerous benefits, including predictability, stability, and transparency in trading costs. In this article, we listed a few brokers that offer fixed spreads to their traders. Needless to say, this is not meant to be an exhaustive list. There are many others that did not make it to our list. We included the brokers we have here because they have reliable regulatory oversight and offer quality services. We believe that regulatory oversight and quality of services outweigh other features when it comes to selecting a broker to invest with. Nonetheless, remember that there’s no single “best” broker. The ideal choice depends on individual trading needs and preferences.

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.