South Africa’s forex trading market is booming, drawing in more and more traders. At the heart of this growth is the Financial Sector Conduct Authority (FSCA), the regulatory body responsible for overseeing the country’s financial markets.

The FSCA plays a vital role in maintaining market integrity by regulating forex brokers, ensuring fair trading practices, and safeguarding client funds. For South African traders, choosing an FSCA-regulated broker is essential for the best trading experience. In this detailed article, we will explore the best FSCA-regulated Forex brokers in South Africa, highlighting their key features. Let’s begin.

Key Factors to Consider When Choosing an FSCA-Regulated Broker

Every trader should select the broker that best suits their needs. However, there are some key factors that all traders must consider. These include:

- Regulation – Ensure the broker is regulated by the FSCA and possibly other reputable authorities like the FCA, ASIC, or CySEC for added security. You can verify the broker’s FSCA registration number on the regulator’s official website.

- Spreads and Commissions – Spreads and commissions are the primary costs of trading. It’s important to compare the spreads offered by different brokers on the assets you intend to trade and pick the one you like.

- Trading Instruments – Most traders want to diversify their portfolios across various global markets. Make sure the broker you select offers the market products you are looking to trade.

- Trading Platforms – The trading platform is your interface with the market. Traders should prioritise brokers that offer intuitive platforms with advanced functionality like MT4 and MT5.

We will use the criteria detailed above to present our picks for some of the best FSCA-regulated forex brokers in South Africa.

HFM

HFM is a globally recognised forex broker with a strong presence in South Africa. This broker is regulated in South Africa by the FSCA under the license number, 46632. On top of that, HFM holds regulatory licenses from other well-known organisations including the CMA in Kenya, the CySEC in Cyprus, the DFSA in the DIFC (Dubai), and the FCA in the UK, among others. This extensive regulatory background is one of the reasons HFM stands out among the top FSCA-regulated forex brokers.

Moreover, this broker allows its traders to diversify their portfolios across a variety of global markets. It offers access to CFDs on forex, energy, indices, stocks, metals, bonds, commodities, cryptocurrencies, and ETFs. Additionally, there are several industry-standard trading platforms to use including MetaTrader 4, MetaTrader 5, and the broker’s own HFM Platform.

In terms of spreads, traders can choose from a variety of accounts which have different fee structures. The Premium account offers spreads from 1.2 pips and the Cent account has spreads as low as 1.0 pips. In countries such as South Africa where the Top-up Bonus account is available, it comes with spreads as low as 1.4 pips. Meanwhile, the Pro account offers spreads from 0.5 pips and the Pro-plus account has spreads from 0.2 pips. None of these accounts charge a commission on forex pairs. Further, the broker also features a Zero spread account that offers spreads from 0.0 pips but has a commission of $3 per side per lot.

The broker does not have a minimum deposit requirement to open Premium, Cent, Top-up Bonus, and Zeo accounts. The Pro account requires a minimum deposit of $100/1,800 ZAR while the Pro-plus account requires $250/4,700 ZAR. It is one of the top brokers that supports the ZAR as an account currency.

Octa

Octa is another excellent choice for South African traders seeking an FSCA-regulated broker. This broker operates in South Africa under the regulation of the FSCA with the license number, 51913. This broker also operates under the regulation of the CySEC in Cyprus and the MISA in Mwali.

On another note, this broker grants investors access to a deep collection of market products. These include CFDs on forex, cryptocurrencies, commodities, indices, and stocks. The spreads involved when trading on this broker site are favourably low starting from as low as 0.6 pips with no commission on both of its trading accounts.

Further, Octa offers three trading platforms to its traders. These include MetaTrader 5, MT4 and OctaTrader. These platforms offer easy-to-use interfaces alongside advanced functionalities, accommodating a wide range of traders. The minimum deposit accepted by this broker is a low $25.

FBS

FBS is a well-established forex broker that has gained popularity among South African traders. It offers its traders three main trading platforms including MT4, MT5, and its in-house built, FBS app. These platforms offer traders user-friendly interfaces for seamless trading. The minimum deposit accepted by the broker is $5 making it highly, accessible to traders.

Additionally, FBS features a deep collection of market products. South African traders can access CFDs on forex, indices, stocks, metals, and energies. This allows them to spread their investment across multiple market products under the same account. Positively, the spreads involved when trading with this broker are competitively low starting from 0.7 pips for major currency pairs on both the Standard and the Cent accounts.

Finally, this broker is well-regulated in several jurisdictions. In South Africa, it operates under the regulation of the FSCA with the license number 50885. On top of that, the broker has regulations by the CySEC, the ASIC in Australia, and the FSC in Belize, among others.

Exness

Exness is a popular forex broker known for its variety of account types to accommodate different types of traders. On this broker site, there are five different accounts for traders to use including two standard accounts and three professional accounts. The spreads involved when trading on Exness depend on the account a trader uses. The Standard account offers spreads from as low as 0.2 pips with no commission charged. Meanwhile, the Standard Cent account has a spread from 0.3 pips also without a commission.

On the other hand, the Pro account has spreads from 0.1 pips with no commission charged. In contrast, the Zero account has spreads from 0.0 pips on the top 30 instruments, plus a commission starting from $0.05 per side per lot. Finally, the Raw Spread account offers spreads from 0.0 pips plus a commission of up to $3.5 per side per lot.

Regarding market products, Exness grants its traders access to over 250 different market products. These include CFDs on forex, indices, commodities, cryptocurrencies, and stocks. To trade these markets, traders can use MetaTrader 4, MetaTrader 5, and Exness terminal.

Another stand-out feature of Exness is its regulations. It is regulated by the FSCA in South Africa with the license number 51024. On top of that, Exness is under the regulation of the FCA, the CySEC, the CMA in Kenya, and the JSC in Jordan, among others. The minimum deposit accepted by Exness is just $10 which is approximately 184 ZAR at the time of writing this. Exness is another broker that supports the ZAR as an account base currency.

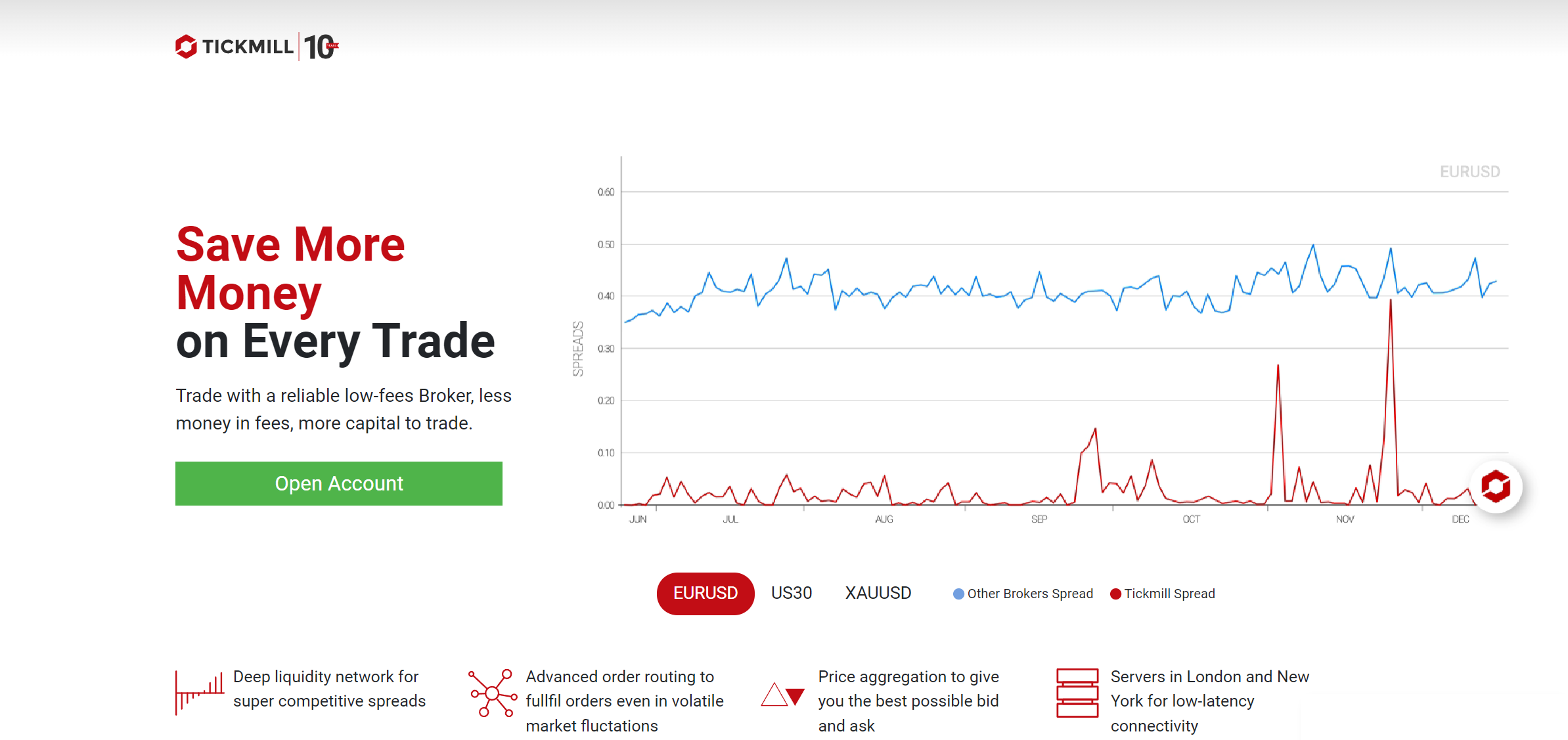

Tickmill

Tickmill is another FSCA-regulated forex broker that caters to South African traders. It operates under the FSCA’s regulation with license number 49464, ensuring compliance with local financial regulations. Additionally, it has regulations by other well-known organisations including the FCA, the CySEC, the DFSA, and the FSA in Seychelles.

Tickmill offers a wide range of trading instruments, including CFDs on forex, stock indices, metals, bonds, commodities, and cryptocurrencies. This allows traders to diversify their portfolios and explore multiple markets. Traders can execute their trades using MetaTrader 4 and MetaTrader 5, both of which provide powerful charting tools, technical indicators, and algorithmic trading capabilities. The broker also offers its own Tickmill Trader.

One of Tickmill’s standout features is its competitive pricing structure. The broker offers spreads from as low as 1.6 pips for major currency pairs on its Standard account with no commission required. It also offers two Raw Spread accounts which have spreads from 0.0 pips plus a commission depending on the account. The commission is $3 per side per lot on the Raw account and $3.5 per side per lot on the Tickmill Trader Raw account. The minimum deposit to open an account on Tickmill is $100.

FP Markets

FP Markets is another FSCA-regulated broker catering to South African traders. In South Africa, FP Markets is regulated by the FSCA under license number 50926. Additionally, FP Markets has supervision by other top-tier authorities, including ASIC, the CySEC, and the FSA in Seychelles, further enhancing its credibility.

FP Markets offers a wide range of trading instruments totalling over 10,000 different assets. These include CFDs on forex, indices, commodities, stocks, metals, ETFs, bonds, and cryptocurrencies. The broker provides access to the popular MetaTrader 4, MetaTrader 5, TradingView, and cTrader.

On another note, FP Markets is known for its competitive spreads and commissions. Its Standard account has a spread that starts from 1.0 pips with no commission charged. In contrast, its raw account offers spreads from 0.0 pips with a commission of $3 per side per lot. The minimum deposit required to open an account with this broker is $100.

AvaTrade

AvaTrade is a globally recognised forex broker that has been serving traders since 2006. In South Africa, AvaTrade operates under the regulation of the FSCA under license number 45984. Additionally, AvaTrade has regulations from other reputable authorities, including the Central Bank of Ireland, the ASIC, the CySEC, and the FRSA in Abu Dhabi, among others.

AvaTrade offers a wide range of trading instruments, including CFDs on forex, stocks, commodities, indices, cryptocurrencies, ETFs, and bonds. In total, this broker allows South African traders to access more than 1,250 different market products. Positively, AvaTrade provides access to the popular MetaTrader 4 and MetaTrader 5 platforms, as well as its proprietary AvaTradeGO platform. It also offers several trading tools like AvaSocial and DupliTrade to further enhance the trading experience of its clients.

One of AvaTrade’s standout features is its fixed spreads, which provide traders with predictable trading costs. The broker offers fixed spreads starting from 0.9 pips on major forex pairs, with no commissions charged. The minimum deposit to start trading with AvaTrade is $100.

Plus500

Plus500 is a well-known broker that offers South African traders a deep collection of market products. These include CFDs on forex, cryptocurrencies, indices, commodities, shares, options, and ETFs. This allows traders to diversify their portfolios and explore multiple markets. In total, Plus500 offers South African traders over 2,800 financial instruments, making it one of the top FSCA-regulated forex brokers in South Africa.

Further, the broker provides access to its proprietary trading platform, Plus500. This platform offers an intuitive interface, advanced charting tools, and risk management features. The spreads involved on Plus500 are variable depending on market conditions and are within market standards. As an example, the spread on the EURUSD pair can go as low as 0.8 pips depending on market conditions.

In South Africa, Plus500 operates under the regulation of the FSCA under license number 47546. Additionally, this broker has regulatory oversight by other well-known organisations including the FCA, the CySEC, and the ASIC, further enhancing its credibility. The minimum deposit accepted by Plus500 is $100.

Final Comments

Choosing the right Forex broker is a critical decision that can significantly impact your trading success. In South Africa, the FSCA plays a vital role in ensuring that Forex brokers adhere to strict regulatory standards and provide traders with a safe and transparent trading environment. The brokers listed in this article are among the best FSCA-regulated Forex brokers in South Africa. Each of these brokers offers unique features and advantages, catering to different trading preferences and experience levels.

Nonetheless, remember that due diligence is crucial. Before opening an account with any broker, conduct thorough research. Visit the broker’s website, read reviews from other traders, and compare their offerings to other brokers. Don’t hesitate to contact the broker’s customer support with any questions you may have.

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.